Redraw Facility vs Offset Account

Many home loans include useful features that aim to help you pay off your loan, whether that’s reducing the amount of interest you pay from day one, paying off your loan as quickly as possible or giving you more flexibility with your finances.

Two mortgage features are by far the most popular and sought-after – a redraw facility and/or offset account. Though both are similar and aim to help you pay off your mortgage faster and save you money in the long run, they are different in how they work.

Home Loan Redraw Facility

What is a home loan redraw facility?

A redraw facility is a handy home loan feature that helps you reduce your mortgage faster. When you make any extra repayments directly into your mortgage, over and above the minimum required monthly repayments, you reduce your loan balance and pay less interest. You also have the added flexibility and freedom to withdraw the extra payments you’ve made when required.

For example^:

Your minimum mortgage payments are $1000 each month, however, you know you can afford to pay in a little more. You choose to add in another $250 on top of $1k. After doing this for a year, you are faced with some out-of-the-blue medical fees that need paying. Instead of being frustrated that you put extra money into paying off your home loan instead of saving it, with a redraw facility feature on your loan, you are able to tap into that extra $3,000 and use it as you need.

How a redraw facility works and why it’s a handy feature

A redraw facility has huge benefits, giving you peace of mind that you can access the extra money you have paid on your mortgage, should you need to.

As well as giving you flexibility when you need the money, you will be paying less interest than you would if you did not make extra payments. In the example above, instead of paying off $12,000, you will have paid off $15,000 in the same amount of time. This means you have paid interest on $3,000 less of your loan.

Another way to use a redraw facility to your advantage is by looking at it like a savings account that helps out while the money is moved out of sight, removing the temptation to spend it all. While you do have the option of withdrawing extra home loan repayments, it is recommended to only do this in an emergency – there may be restrictions on the amount and frequency of any redraw, and you may be charged fees. It’s best to check the terms and conditions of your loan to be sure you are getting exactly what you want and need.

Mortgage Offset Accounts

What is a mortgage offset account?

By utilising the benefits of a mortgage offset account, you can save money by reducing the amount of interest you pay on your loan. An offset account is an everyday transactional account linked to your home loan, and every dollar in this account offsets the balance of your loan, on top of what you have already paid off.

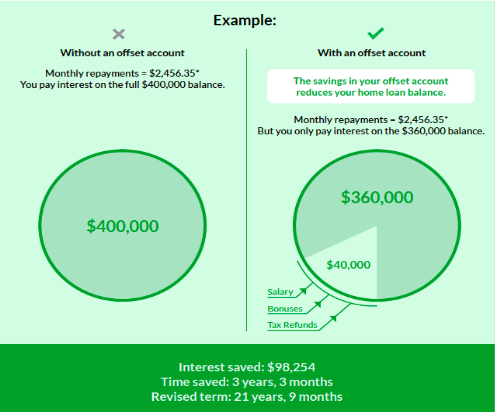

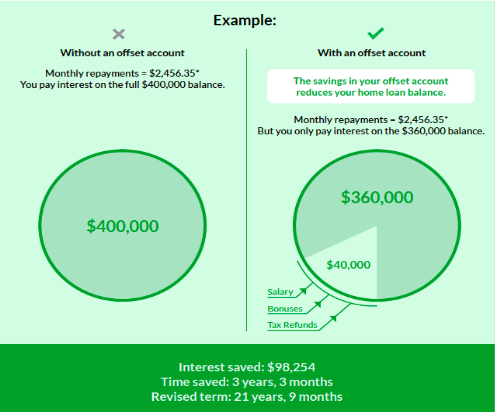

For example^:

If you have a $400,000 mortgage and there is $40,000 in your linked offset account – you will only pay interest on the balance of $360,000.

Meaning the more you have in your offset account the more interest you will save!

*The results above are an approximate guide and should not be used as exact values for financial planning purposes. The results do not constitute an offer to provide credit and do not imply that credit is available. The example above is calculated based on 5.5% interest rate over a 25 year home loan term. It is to be used only as an indication of the interest and time you could save by having money in your Offset Account. Interest rates may change at any time without notice.

What type of home loans can you use with an offset account?

We include an offset account as a feature to many of our home loans, and we also offer a Toggle Offset loan. This loan gives you the added bonus of half of your loan being variable, and half being a fixed rate, with an offset account to use on both. You can ‘toggle’ between fixed and variable as you see fit.

How do you make the most of having an offset account?

Interest is calculated daily, so every single day that money sits in the account will benefit you. Most choose to have wages paid directly into their offset account and then take money out as needed, which will lower the interest payable. Some use their offset account to stash their savings, helping offset the loan balance with a lump sum and for a longer period of time. Others do a mixture of both.

Putting your wages into the offset account, and then using a credit card to pay for monthly expenses can be beneficial if you’re savvy. By keeping all your money in an offset account for an entire month, it will reduce interest payable. By paying the credit card bill on time after the interest-free period, with money from the offset account, this method could work well for many.

Another way of using the offset account to your advantage is to aim to put as much money as possible into the offset account instead of making extra repayments to your loan. Not only will you pay off your home loan quicker, but if you do need the extra money for an emergency, or if interest rates rise, then you have an easily accessible buffer there waiting.

Have a look at our tips for maximising the benefits of your offset account.

Does having an offset account reduce your monthly repayments?

Having money sitting in an offset account will not affect your monthly repayments, which will remain the same. However, what it will do is over time help reduce the length of your loan term and the amount of interest you pay. As the interest on your home loan is calculated on a daily basis based on the balance and charged monthly, the more savings you keep in your offset account and the longer it stays untouched will help reduce the interest charged.

Offset or redraw – which one leave homeowners better off?

Both offset and redraw features are positives that can help you manage your home loan. Ultimately it comes down to your own personal preference, and whether you would rather have easy access to your funds while decreasing interest, or more equity in your home without the temptation to spend.

Mortgage House

At Mortgage House, we’re no strangers to the homeowner’s journey. It’s a long (but rewarding) one.

But don’t worry, we can help with that.

If you’re thinking of buying a home, you can contact us for information about the best options for you when it comes to your mortgage.