What is a Self-Managed Super Fund?

Unlike the other fund types, a Self-Managed Super Fund (SMSF) gives you the maximum amount of flexibility with regards to where your retirement savings are invested. When it comes to investing through an SMSF, you have an almost unlimited choice of asset types to choose from, allowing you to take your destiny into your own hands and grow your retirement savings in the way you believe is best for your future. While you will have more control by way of deciding where to invest your money, you will have to also comply with tricky tax rules and legal restraints.

What an SMSF can provide:

The ability to borrow money

Australian residents have been using their SMSF to purchase investment properties for many years, but you can now use your SMSF to borrow the money you need.

Superannuation-only tax benefits

- Don’t pay capital gains tax once you’ve retired

- Pay a maximum tax rate of 15% on rental income after expenses, and any capital gains on the disposal of the property

- Be eligible for tax-deductible loan repayments if you pay your super fund through salary sacrifice

- Claim further tax deductions on many costs relating to the purchase, management and sale of the property

A way to diversify your assets

Diversifying your assets can strengthen your super fund and generate less risk, so this is just another way to spread your asset portfolio across different investment sectors.

A dream home to live in once you retire

While working, the property is in the name of the fund. However, once you’re retired and you’ve started receiving your super payments, you can use money from the sale of your own property to buy the property from your super fund. then sit back and enjoy your twilight years in your dream property!

What to be cautious of:

Restrictions

You can only buy an investment or commercial property through your SMSF, which cannot be used to benefit you or your family before retirement. If you rent the property out, it must be to tenants outside of your family.

The costs of purchasing, maintaining and selling property

- Purchasing a property can result in heavy fees such as stamp duty, and when it’s time to sell, these fees apply again.

- An investment property should provide you with a steady monthly income, however, you may go some time without a tenant.

- You’ll be responsible for maintaining the property over the lifetime of the investment. Though you can borrow to purchase the property, you cannot borrow to do it up, so you must ensure you have sufficient funds to use as and when needed.

- Property takes far longer to sell than shares do, and selling can cost a fair bit too. You may also be stung by the housing market when you want to sell – the value of your property may not have risen.

Superannuation: how Mortgage House can help

Mortgage House works with Perpetual Private Clients to offer you a range of quality superannuation funds and services including:

-

Personal and employer super funds customised for your situation and life stage

-

DIY, self-managed super funds and small APRA funds

-

Making the most of superannuation tax concessions

-

Superannuation planning to help maximise your retirement savings

-

Accessing part of your super in the lead up to retirement (transition to retirement strategies)

Our range of superannuation solutions make it easy for you to manage your super and save for retirement.

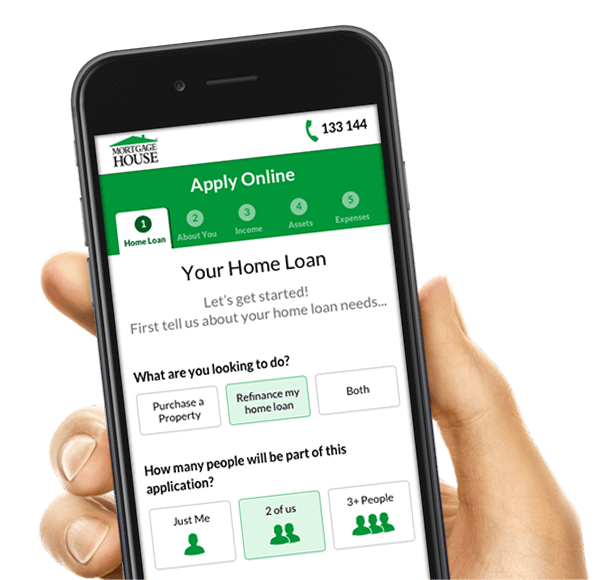

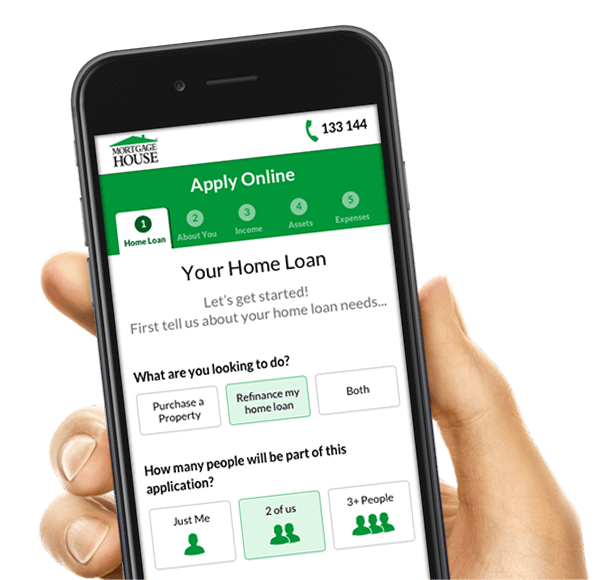

If you need advice on how to make the most of your super or are looking to establish a self-managed super fund, we can help. Contact us or Apply Online by clicking the button below.

Apply Online Anywhere, Anytime.

Less paper work

& waiting time

Complete the

form in 15 minutes

Save and come

back anytime