The Mortgage House Everyday Transaction Account

What Can You Expect from the Mortgage House Offset Account

Up to 10 offset accounts.

You can segregate your funds according to your different financial goals,all while reducing the interest on your home loan.

It’s a Win, Win

Every dollar put into the offset account‘offsets’ daily, against the loan balance

= It reduces the amount of interest

payable by you every single day.

Interest Savings

If you have wages paid into your everyday transaction account you will always save on payable interest.Maximise Savings

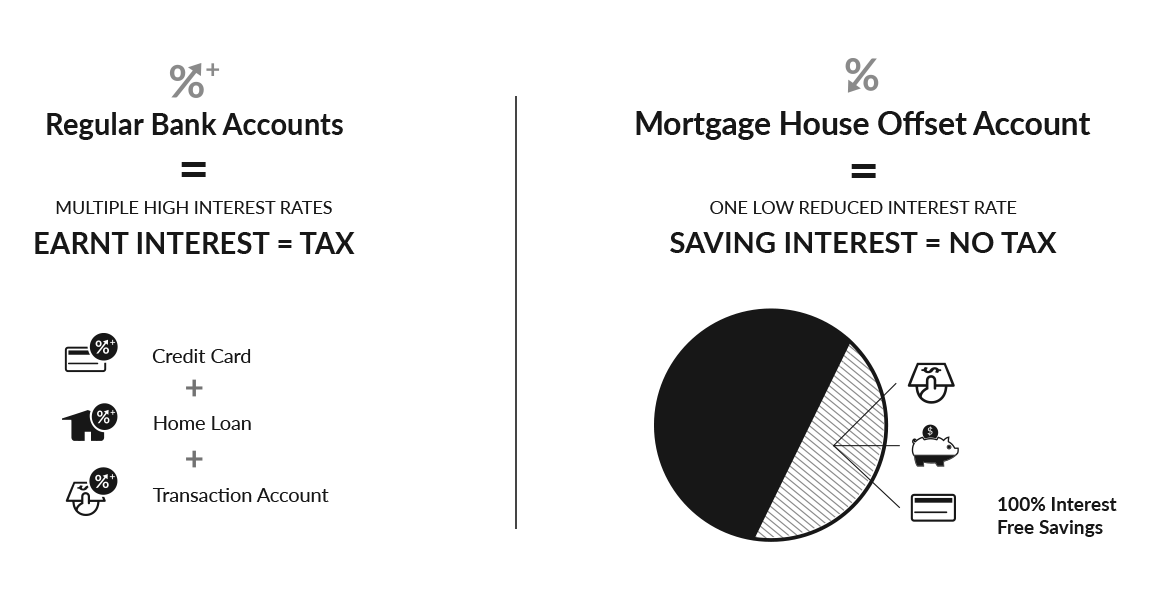

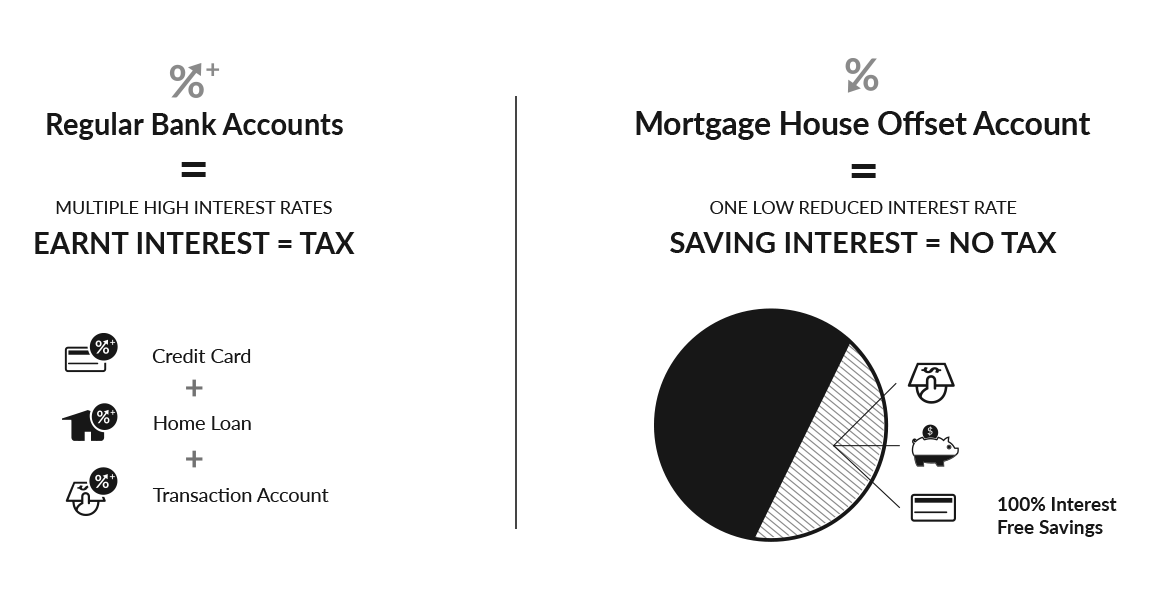

Benefit from reduced tax free interest on your everyday transaction account.Why an Offset Account?

The Mortgage House Everyday Transaction Account

An offset account is a home loan feature that helps borrowers save on interest. Money deposited into this account offsets the interest payable on the loan. This is different to a regular bank account, as from the moment you take out your first loan, a bank account starts to cost you thousands of dollars over your borrowing life. That’s because the interest you pay on a loan is often far more than the interest you earn on a bank account.

We offer the flexibility of up to 10 offset accounts.

You can segregate your funds according to your different financial goals, all while reducing the interest on your home loan. You can attach a different card to each of your offset accounts allowing for an organised approach to managing your money and maximises your savings potential.

Need More Clarification?

Need More Clarification?

Without an offset account

Interest is charged on $400,000

Monthly interest

$1,666.67*

With an offset account

Interest is only charged on $360,000

Monthly interest

$1,500*

Equates to:

Savings of $2,000 per year

Savings over loan term

$60,000*

What people are saying

Wouldn’t go Anywhere Else

"We have always used Mortgage House for our Home Loans and I would never want to look elsewhere. They are always available, no matter how many times you contact them. They are patient, friendly and professional. Not to mention they offer amazing loans! To sum it up in two words, my experience with Mortgage House is "too easy".

First Rate Service

"Excellent service from start to settlement. Nothing was too much trouble and response times were extremely prompt. A big thank you to my lending specialist Kristie for a job extremely well done. Would recommend her and Mortgage House to anyone. Thanks again, Andy

Fast, easy and saved me a small fortune

I have never received the level of personal service that Ken and the team at Mortgage House have provided. I think this is what people are talking about when they use the term "old fashioned service". Mortgage house have gone above and beyond in helping me refinance my home loan, along with offering a far better interest rate on my loan than my previous bank. I made the move from one of the big 4 and wish I had done so earlier - I would (and do) recommend these guys to anyone.

Useful Links

Useful Links

Our Success is Your Success

We continue to achieve industry recognition for excellence in customer service and low-rate loan products. When you come to Mortgage House, know that you are in the safest hands.

We continue to achieve industry recognition for excellence in customer service and low-rate loan products. When you come to Mortgage House, know that you are in the safest hands.

ProductReview.com.au

Home Loans - 2023 Winner

ProductReview.com.au

Best Home Loan Lender 2022

Money Magazine

Best-Value Basic Home Loan(Non-Bank) 2022

RateCity

Best Variable Home Loanfor the Chameleon Executive Home Loan 2022