Which property?

You’ve qualified for tens of thousands of dollars in incentives from the boosted First Home Owner Grant. Now, the question is: where should you spend it? Kit Kadlec reports

There’s a buzz around lately, with many young Australians tempted by the timing of incentives offered to first homebuyers – and especially for new homes.

Real estate agents, builders and brokers alike are seeing a dramatic jump in the number of interested visitors to their offices. These potential buyers are curious, and wondering if the present conditions are ripe for getting into the market. They also realise these incentives are combined with interest rates that were lowered recently, and that housing prices around the country are either flat or depressed.

Wait too long, they surmise, and those incentives may run out – and housing prices might rise again as well.

It’s actually not quite so simple, however. The global financial situation is also weighing on many homebuyers’ minds, and negative media reports, too, have fed into the fear.

“People are tempering their decision based on what the next 12 months holds for them,” says Tony Pizzolato, Australand’s general manager for NSW residential.

No time like the present

But apart from any concerns relating to the economy, many property experts say there may not be a better time to buy than the present, particularly with the current incentives and flat prices.

“It’s a major factor and I think you’d have to be crazy to ignore it,” says Brett Johnson, managing director of Quartile Property Network, of the government incentives offered.

Those buying a home for the first time are eligible for at least $14,000 in government funds – and $7,000 or more than that if the purchase is a new property.

Johnson says that even those residents with little or no savings can jump into the market now, given that they have a good job to secure a loan and are willing to live in an affordable area. These young first homebuyers with low savings might need some help from parents with a deposit before the government pays the grant. But overall, with the grant and boost, savings can approach $30,000-40,000 in some states, in addition to the stamp duty discounts offered.

“You could spend the next five years of your life saving $40,000,”says Johnson. “This is a window of opportunity through which you can jump five years ahead in the housing cycle that previously simply didn’t exist.”

A word of caution, though, says Johnson, that even with the benefits of the government grant, if you buy the wrong property, it’s all washed away.

“If you bought a property and saved $30,000 or $40,000 (from the government grant), but then found a year later it’s worth $100,000 less, that’s not a good deal,” he explains, “so the state of the market is relevant.”

Using the grant to invest

There are many variables in the boosted First Home Owner Grant, not the least of which is a larger sum of money for those buying a new home rather than an existing one.

In NSW, for example, the difference is $10,000 ($7,000 in additional federal money plus $3,000 in additional state grant). Not everyone wants the hassles of building a new home, and in many cases it would be a considerable distance from the CBD. Buying a new home off the plan, too, would often mean it’s just as far out.

However, even those first homebuyers looking to buy an existing property have little choice in many of the capital cities, where there may be homes for sale, but they are mostly out of their price bracket. In six out of eight capital cities, median house prices are above $440,000, according to Residex, and above $500,000 in two of those.

A government report earlier this year stated the average house price in the capital cities is now equivalent to over seven years of average earnings, up from three in the 1950s to the early 1980s.

For those new to the real estate market, properties are still within an affordable range only in the outer suburbs.

Johnson is very much an advocate of first homebuyers getting the most out of the grant – which means buying a new home and getting the additional $10,000.

“I think the best way to take advantage of it is to say, ‘Okay, this is the key – this is what gets me into the market’,” he says. “It’s the best application of the grant.”

Buying new homes

In addition to the extra cash, Johnson says there’s plenty of room for growth with the new homes built in some of the mid-toouter suburbs.

“People are buying property off the plan, which – from a cyclical point of view – makes sense,” he adds.

Johnson especially advocates buying in Sydney, where housing prices have been flat for a number of years.

He cites the example of a chef from Surry Hills who recently bought a new house in Penrith, west of Sydney, for $292,000. He had $17,000 in cash, and borrowed the rest. Johnson says this buyer doesn’t plan to live in the property permanently – just the time required to qualify.

“In fact, there are good times to buy into a housing market, and also that aren’t so good,”

The property would bring in $320 per week in rent and, while that leaves the buyer owing an additional $72 per week in the first year to hold the property, Johnson says the point of such a rental investment is not for immediate gains.

“You are in it for the capital growth,” he explains.

Making such a purchase is not very difficult, either. Johnson says all anyone needs is just $26,000 in annual income to secure a loan of $290,000.

“That’s how easy it is – it’s extraordinary,” he says, adding that Australian banks have plenty of money to lend at the moment, despite a growing negative perception.

“This is a window of opportunity through which you can jump five years ahead in the housing cycle that previously simply didn’t exist”

“You are in it for the capital growth,” he explains.

“That’s how easy it is – it’s extraordinary,” he says, adding that Australian banks have plenty of money

he says. “But now is a good time in Sydney as prices have remained stagnant for seven years. We’re not saying it’s going to go through the roof, but over the short to medium term ahead, it should be favourable.”

Even when taking the incentives from the grant, these new homebuyers don’t need to live in the property themselves for any more than six months, based on national and local requirements. So those who prefer to live in the city can make the purchase in a suburb further out, then go back to renting in town while they reap the capital gains over time.

“You live in it for 26 weeks of the year, then you can move and rent it out,” says Johnson. “It then becomes an ongoing rental property.”

Rule-breakers don’t prosper

Those who go forward with this and use their purchase as an ongoing rental should be aware of the requirement of living in the property. The new owner, if using the government grants for first homebuyers, must live in it for six months within 12 months of the purchase.

Violate that – or any of the other conditions involved – and you risk some heavy fines that could add up to as much as $80,000. In addition to doubling what you were awarded in the grant and boost, you are subject to a flat fee of $11,000.

Johnson says the government has ways of tracking down violators.

“They have field officers who knock on your neighbours’ doors,” he says. “First Home Owner Grants have been around for [ages]. They’ve had time to figure out how to catch you.”

Penalties also apply for making false or misleading statements.

Buying an existing home

Even with all the incentives, there are many who prefer to stick to buying an existing home as, for them, the worry of buying something before it is built is just too much.

“The walls are up, it’s finished – you take it as it is,” says Pizzolato. “And you don’t have the hassles of getting approvals or working over construction issues with the builder.”

After all, you can buy an existing home and still take full advantage of the grant and boost. As long as the property is new

- that is, nobody has lived in it since it was either built or significantly renovated

- the buyer qualifies for the whole grant.

However, for those with a preference for an existing previously occupied home, the decision makes it a bit tougher financially. As stated earlier, choosing new over existing can gain first homebuyers between $7,000 and $10,000 in the government boost, making the option more enticing.

That’s simple maths, but the reason one might still prefer an existing, previously occupied home is that the property value might be more favourable in the future. For example, if you buy land and build a house in some distant suburb and the value of the property stays flat – or even drops – over the next few years until you decide to sell, it’s possible that the savings made on the grant would be cancelled out compared to an existing home elsewhere.

Still undecided whether to buy a new home over an existing dwelling? Turn to page 38 for an in-depth analysis of the merits and disadvantages of the options.

Buying off the plan

Some of the more affordable options are in suburbs not so well established, and that often means buying either brand-new homes or vacant land to build one on.

Pizzolato says there are certainly reasons for doing either. The government incentives with the grant are pretty much the same, since either option is considered a new home. So it often comes down to personal preference in picking the better option for yourself.

“It’s a changing lifestyle in Australia,” Pizzolato says. “A lot of people want the finished product without the hassles that come with the builder. On the other hand, some people love it and see building their dream home as a fantastic period in their lives. It’s really personal choice – and there are pros and cons to both options.”

When building a new home, you can have some – or even total – input on the look of it, including the overall design, paint colours and architectural style. In fact, rooms can be designed specifically to meet your needs.

“A large part of your life might be working from home, so you can custom design a home office – or some other special room,” says Pizzolato.

Doing things a little differently like that, however, can throw some variables into the construction process which, in turn, can increase the risk of delays or other problems.

Those buying off a pre-designed house plan forgo that flexibility, often exchanging it for a lower price and fewer hassles throughout the construction.

Whether you buy off the plan or build new, those looking to qualify for the grant and boost must have a sunset date of no later than 31 December 2010. ‘Sunset’ refers to an agreement with the developer that, if the property is not built by that specific date, the buyer can walk away from the contract.

When buying anything prior to construction, you are unable to inspect the property which is a disadvantage as, instead, you have to rely on an artist’s impression of your home. That leap of faith is sometimes challenging, especially for those who are new to the market.

Dos and don’ts when buying off the plan

Do

|

Don’t

|

What to look for when buying ‘off the plan’

1. Settlement period

This refers to the legal handover and usually involves the final payment.

If you fail to meet settlement, in some circumstances the seller has the right to cancel the contract with you and to re-list the property for sale.

This would be at a higher price than you first agreed to if the market has moved on during the several months that would have passed between the offer and the settlement date.

This might seem like an unlikely scenario but sometimes delays in settlement are beyond the buyer’s control. If you require a loan to purchase the property, the banks may not be able to offer finance with such a long settlement period. You would have to reapply for finance at a time closer to settlement, and it may not be offered.

Even if you’ve paid stamp duty on the land, had the contract stamped and sold another property to move into your dream home, it could come unstuck due to an overdue settlement that isn’t directly your fault.

At this point, the sellers and developers could cancel the contract and re-list the property for sale.

2. Sunset clauses

For anyone thinking of buying land or an apartment off the plan in a development, it’s wise to enquire about any sunset clauses in the contract.

Does it contain any circumstances that could give rise to the seller’s contractual right to withdraw and terminate the contract? If so, what are they?

In other words, are there any special conditions in the contract that you as the buyer should know about before signing anything?

It’s important to take the time to read and understand the contract to ensure you make an informed decision and aconfident purchase.

Source: REIWA

Owner-occupier

While there can be substantial financial appeal in turning your first homebuyer benefits into a rental property and investment, there are many Australians who would prefer to use it to buy a place they’d like to live in themselves.

This growing demographic has been the biggest source of sales in the early weeks of the first homeowner boost, according to many agents and builders.

“Things were going really slowly for us before the boost was announced – they were barely grinding along,” says Terry Sullivan, sales and marketing director for Jandson Homes.

Sullivan recalls having only five sales in one month so, even for a smallish-size builder like Jandson, times were bad.

Then, in a single weekend in November, Sullivan says, he took nine deposits.

“We were really knocked off our feet,” he declares.

Despite an intensive advertising campaign in local newspapers, he says, it wasn’t until the boost came along that buyers started coming back into the market.

Limited time only

While the boost has an expiry date of 30 June, it is also limited by an amount – $1.5bn. How long that figure is going to last is unclear, as it is highly likely that many people who would want to take advantage of it are still biding their time.

“People seem to have decided to think it over until after Christmas,” says Pizzolato. “The market is still very much lacking in confidence – and commitments from people.”

Other adjuncts to the grant, such as the additional $3,000 to the boost in NSW, are restricted even more. In that case, the boost is limited to $9m, which equates to 3,000 grants.

“Three thousand grants is pretty much a drop in the bucket,” Johnson says. “That won’t be around for too long.” YM

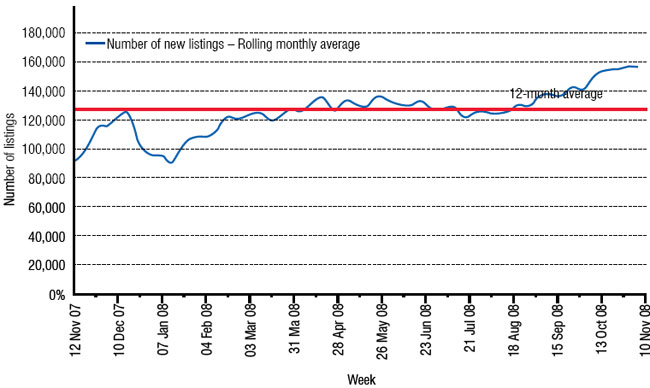

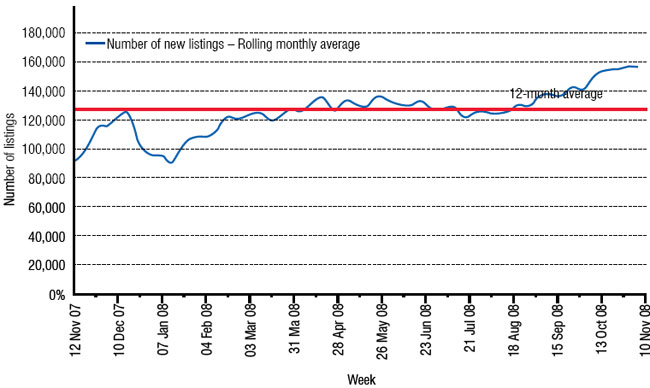

New residential listings advertised each week

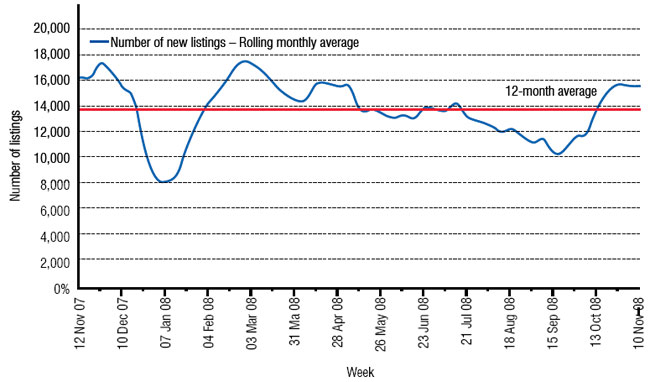

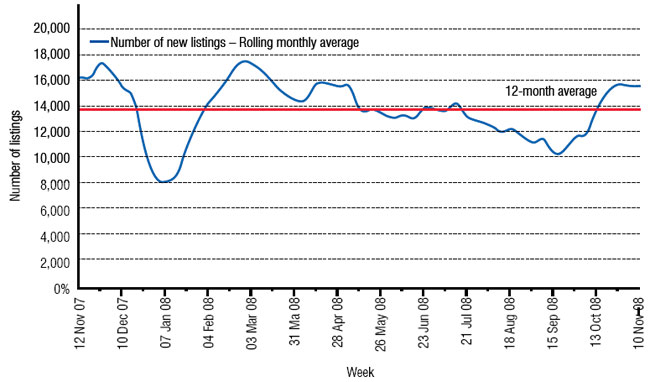

Total residential property listings each week