What is the Loan to Value Ratio (LVR) and why is it Important?

LVR, or Loan to Value ratio, is the percentage amount you are borrowing compared to the value of the property you are buying. If your property is bought at $1,000,000, and you have put a deposit down of $200,000, your LVR is 80% – you’ve put down a 20% deposit and have borrowed 80% of the total value of the property.

It can also be determined while you are paying off your loan. For example, you have paid off $500,000 of your $1,000,000 property, meaning your LVR is now at 50%.

What is LVR used for?

Calculating your prospective price range

If you have savings, you can see what your LVR is on these which will, in turn, determine how much you can afford to spend on buying a property.

If you have $50,000 saved up, and you don’t want to have an LVR of over 80%, then you know that the maximum property value you can afford is $250,000. Being able to calculate the LVR can give you a guide of how far your deposit will allow you to borrow.

To determine your risk factor, and whether you pay LMI

In general, the lower the LVR, the less of a risk you are, and the more chance a lender will accept you for a loan. While many lenders will offer you a home loan with an LVR of over 80%, this may incur more fees and higher interest rates.

To determine the equity you have in your property

Equity is the difference between the current market value of your property and the amount you still owe on your mortgage. For example, you still owe $300,000 on your mortgage and your property is currently valued at $1,000,000, then you have a $700,000 in equity. Equity could be used as a deposit for an investment property.

If you wanted to see how much your equity could get you in an investment property, you would use your LVR. To calculate this, you would multiply your property value by 0.80%, then minus the amount you still owe on the property. This provides the amount in equity you can put towards an investment property.

What does 80% LVR mean?

The vast majority of Australians must take out a loan to buy a property. The higher the deposit you put down, the less your loan will be, meaning you are in a better position to negotiate a lower rate or more loan features which can enable you to pay off your home loan sooner.

LMI (Lenders Mortgage Insurance), is a premium that’s charged over and above your loan amount if you’re looking at applying for a home loan with a deposit less than 20% of the amount you wish to borrow. This extra fee can be avoided by saving more before purchasing a property but does allow those with a smaller deposit to get onto the housing ladder.

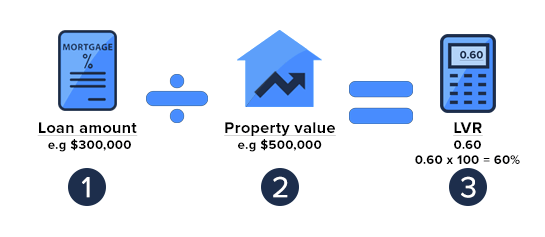

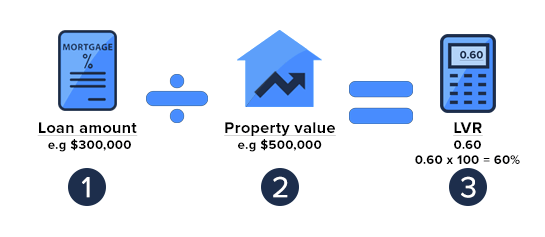

How do you calculate LVR?

If you are looking to buy a property, you would need to calculate what you may be able to purchase with a 20% deposit. To do this, you take your savings and multiply this figure by 5. For example, you have saved $100,000, so with an 80% LVR, you can afford a property with a value of up to $500,000.

To calculate the LVR on your property or prospective property, divide the loan amount by the property value, and times by 100 to get a percentage value.

Source: Finder

To save for a 20% deposit or higher, budget your expenses using our simple budget planner calculator.

Mortgage House

At Mortgage House, we’re no strangers to the homeowner’s journey. It’s a long (but rewarding) one.

But don’t worry, we can help with that.

If you’re thinking of buying a home, you can contact us for the best options when it comes to your mortgage. We can also tell you about alternative ways of getting into the market with a smaller deposit, like guarantor and family pledge loans. You can use our calculators to find what’s the best loan for you.