The Price of Power

The cost of electricity continues to be front page news and is placing stress on household budgets. If you are feeling the heat, you are not alone. We’d like to help you identify a few key areas related to your household’s energy bill including:

- how much costs have risen,

- the main areas of energy consumption in households across Australia, and

- the appliances that are costing you the most to run.

Increasing costs

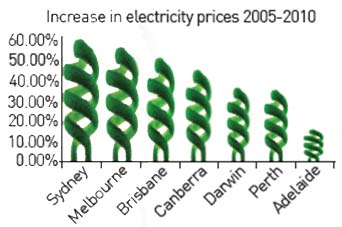

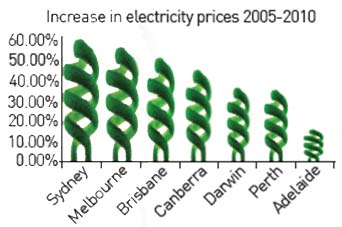

It is no wonder we are feeling the squeeze. According to the Australian Bureau of Statistics, over the last five years electricity costs have risen from 16% in Adelaide to a massive 60% in Sydney – between 5 to 21 times the inflation rate!

Source: ABS, Catalogue number 6401.0

Reasons for rise

- Old energy infrastructure across the country needs to be upgraded due to neglect from a lack of funds over the past few decades.

- The introduction of renewable energy initiatives.

Main areas of energy consumption

As energy costs continue to rise throughout Australia, we should all be looking for ways to reduce our usage and therefore our bills. By understanding the areas of your household that consume the most energy, you can begin to take positive action to reduce the impact these bills have on your household budget.

| Heating and cooling | 36% |

| Water heating | 24% |

| Other appliances | 20% |

| Fridge and freezer | 7% |

| Lighting | 7% |

| Cooking | 6% |

Source: Energy Australia

The above chart gives you a good idea of the general areas that are responsible for the greatest percentage of energy use, helping to identify the areas that we need to look at. Some general tips to reduce costs for these areas are:

- Reduce length of showers. Many newer electric hot water services have a ‘booster’ system, which means even if they are on an off peak service, the booster cuts in throughout the peak period topping up the system and increasing your bill.

- Wash clothes using cold water.

- Choose appropriate thermostat settings on your reverse cycle air conditioning (20ºC for winter heating and 25ºC for summer cooling). Varying the thermostat by as little as 1ºC can have up to 10% impact on costs.

Which appliances cost the most?

To really drive home the impact energy costs have on your household budget it is useful to look at how much your appliances are costing you in real terms:

Appliance |

$ Cost per quarter |

| Pool heater (heat pump) | 434 |

| Ducted air conditioning | 268 |

| Wall mounted air conditioning | 166 |

| Electric storage hot water unit | 150 |

| Pool pump | 95 |

| Pool heater (solar) | 48 |

| New refrigerator 500 litre | 30 |

| 400 litre freezer | 30 |

| Salt water chlorinator | 26 |

| Plasma TV | 20 |

| Bar fridge | 15 |

| Large LCD TV | 10 |

Model, age and use can influence running costs. Estimated costs are based on Energy Australia’s domestic all time tariff for 2010-2011 for NSW.

Please call the office on 133 144 if you need some help with your household budgeting. We have some great tools that can help you get your finances on track