Do You Have Questions about Land Tax?

If you own a property that’s worth more than the threshold in your state, you will likely have to pay land tax on that property.

Land tax comes in the form of an annual charge. The amount is a percentage of your property’s value past the threshold.

So for instance, if the property value is $600,000 and the state threshold is $549,000, your property will be $51,000 over the threshold. In this scenario, you would pay $916 of land tax each year (1.6% of $51,000 + $100).

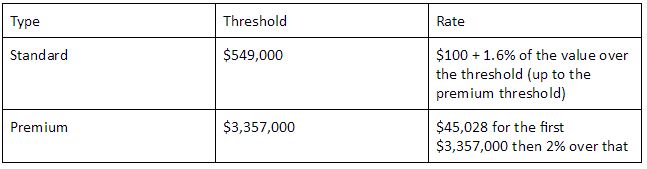

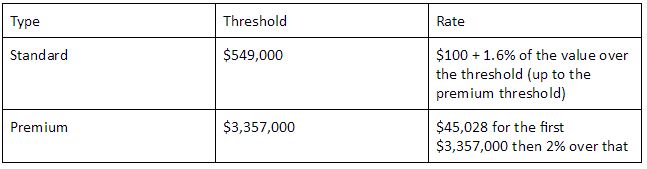

Rates and thresholds are subject to change each year, but these are the current rates and thresholds in Australia:

SOURCE: https://www.revenue.nsw.gov.au/taxes/land

There are a variety of ways that homeowners in Australia avoid (or at least mitigate) their land tax spendings:

Invest in multiple states

One of the most common solutions is to invest in properties in multiple states.

In this scenario, each property is considered independently rather than cumulatively. This is an effective way to invest large amounts of money into property without paying land tax.

Invest in units rather than houses

Houses have more land value than units due to their size and other factors. By favouring units over houses in your investment portfolio, you might be able to mitigate land tax quite substantially.

As always, we advise consulting with us or with your accountant before making any decisions. Every situation is different. The cost of the body corporate, for example, might offset any land tax savings you stand to make.

Use different entities

You might be able to avoid land tax by putting your investment properties under different entities.

For instance, if you’re married and own four properties with your spouse, a good way to avoid land tax might be as follows: Put one property in your name, the second in your spouse’s name, the third under a trust and the fourth as a joint ownership.

Four different entities owning the properties, and therefore, no land tax.

Mortgage House

At Mortgage House, we’re no strangers to the homeowner’s journey. It’s a long (but rewarding) one.

But don’t worry, we can help with that.

If you’d like to know more about land tax, you can contact us for advice about your mortgage and investing in property. The cost of your mortgage can drastically affect your financial planning, so it pays to speak to the experts about it.