How can pre-approval help you?

Before you formally apply for a home loan, many lenders will offer you a home loan pre-approval or conditional approval. They are issued early on in the application process, after a quick check into your finances.

Both pre-approval and conditional approval are used primarily to gain clarity on what financial backing you can realistically expect to achieve. Then, as long as the information provided is correct and the application continues without any hindrance, your home loan will be formally approved. The good news is, a lot of the information you need to apply for pre-approval will be used when it comes to formal approval, which means less work down the track!

Upload documents

By uploading copies of your passport and proof of income, you can fast track your home loan application to be ready for review.Application review

When you discuss your requirements with your Lending Specialist, they will find the best loan with interest-saving features to suit your needs.Pre-approval

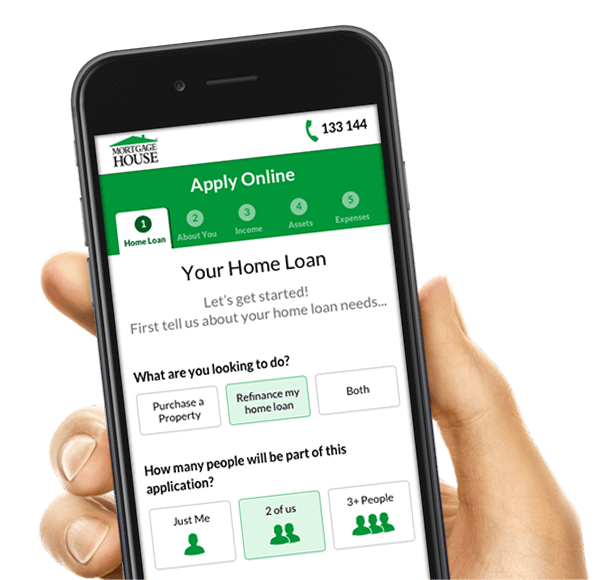

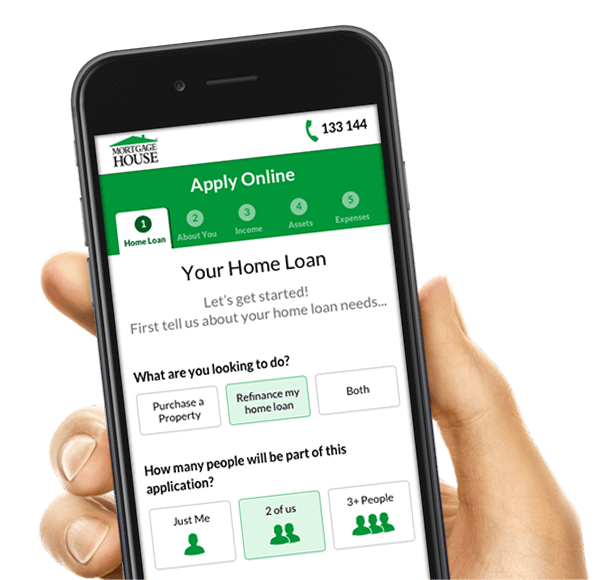

Pre-approval and conditional approval are agreements in principle that confirm your home loan will go ahead subject to further assessments.Apply Online Anywhere, Anytime.

Less paper work

& waiting time

Complete the

form in 15 minutes

Save and come

back anytime

Commonly asked questions

What is conditional approval?

Conditional approval is a confirmation from Mortgage House that, on the basis that all required information provided is factually correct, you will be given approval subject to various conditions like successful credit checks. With conditional approval, you’ll be ready to put an offer on a property as soon as you find the perfect match.

What is pre-approval?

Pre-approval is the confirmation from Mortgage House that, now that the property you wish to purchase has been valued and we have all required information from you, provided final checks are completed successfully, you can proceed with making an offer with our financial backing.

How is pre-approval different to conditional approval?

If you want to start seriously looking for a property, your offer will be stronger if the loan amount has been conditionally approved. If you have found the property for you and have had it valued, you can be pre-approved for the home loan and the property in one go.

I've found a property and I'm ready to make a serious offer - what now?

If you already have conditional approval, go right ahead! You can put a conditional offer down on the property to secure it.

If you don’t have a conditional approval but have already found the property you want to make an offer on, getting pre-approval is the way to go. Begin by applying online!

Can you get multiple pre-approvals or conditional approvals?

When looking for the right financial product and the interest rate the advice is always to ‘shop around’, but when you apply for home loan pre-approvals the opposite is true. Applying for multiple conditional or pre-approvals can have a negative impact on your credit score. A home loan pre-approval is considered a hard enquiry and therefore will have an impact on your credit score. One enquiry in itself is not a bad thing, but multiple enquiries over a short time period can be. This is because multiple hard enquiries may suggest financial stress to a lender and are viewed unfavourably.

Research is still important, but it should be done well before you formally apply for conditional approval. A conditional approval should not form part of your research and comparison, rather, you should only apply for a home loan conditional or pre-approval once you have decided on a suitable lender.

Is it better to get pre-approval or conditional approval?

Pre-approval (for those with a property they’d like to purchase lined up) or conditional approval (for those who are yet to find their dream property) are both helpful tools when looking to buy a property. They are both formal indications of how much a lender is willing to loan you, though a pre-approval will have had more checks done on the chosen property, showing the lender is satisfied with the hopeful purchase and not just your ability to repay the loan.

Mortgage House can provide you with a FREE home loan conditional or pre-approval in just minutes. The best way to start is to Apply Online – just click the link above to begin! Alternatively, you may call 133 144, or fill in the Enquire Now form at the very top of this page.

IMPORTANT DISCLAIMER: Pre-approvals and conditional approvals are valid for 3 months. This is intended as a guide only. Details of terms and conditions, interest rates, fees and charges are available upon application. Mortgage House’s prevailing credit criteria apply. We recommend you seek independent legal and financial advice before proceeding with any loan.

What resources can help me get pre-approval for a home loan?

Can I compare loans before being pre-approved for a mortgage?

While choosing between mortgages can be overwhelming, given the choice on the market today, comparing mortgages has never been easier. Looking at interest rates and repayments can be helpful, but comparing all the other aspects of the loans can be a lot more useful. Being able to compare features, fees, loan purposes and repayment options can help you get a bigger and better picture of which loan might be suitable for you and your property goals.

What is conditional approval and is it the same as pre-approval?

Conditional approval and pre-approval are both terms that describe the same thing. They both describe a quick and very early enquiry into your financial situation before you formally apply for a loan. Ideally, pre-approval will happen before you begin looking for a house, so you can get an indication of what house prices can be within your reach. One of the best things about pre-approval is you will have a clear picture of what you can realistically afford, and what your budget should be. That can stop you getting overzealous, or wasting your time looking at properties you are unlikely to be able to afford. Pre-approval also has other practical benefits. While a lot of people at an auction, for example, can just be there to check out what the local market is doing, having pre-approval for a loan can tell the auctioneer you may be a serious bidder. This can give you more bidding power, and can also ensure any bid you make is backed up with a high level of confidence. Every bank or lender can have different pre-approval requirements, so make sure you understand what they are before asking for pre-approval.

When should I apply for loan pre approval?

Applying for conditional approval, or pre-approval can be smart planning. Being strategic about your mortgage application can be important. It is a good idea to apply for pre-approval after you have used our borrowing calculator and you have an indication of your borrowing potential. As mentioned above, work out what monthly payments you can afford, and look at all the types of loans Mortgage House has to offer, and which ones may be suitable for you. It can also be a good to have an understanding of the local property market, and what your borrowing power can allow you to buy. Buying a property is likely to be the most expensive decision you have ever made in your life, so putting in as much planning as you can, can be beneficial. Use our Loan Application Documentation Checklist as an early guide to what you will need when applying for a loan.

Is pre-approval for home loans all I need?

No, you still need to go through the full application process before you are approved for home loans of any type. This is important, not the least when it comes to auctions, or putting in offers on a home. You still need to gain full approval from a bank or a lender after a successful auction bid. This will involve a valuation of the property and the cross-checking of your documentation. Pre-approval is a quick check on your ability to service a loan, not a final approval. Pre-approval can’t be used to make an offer on a property. You will need unconditional approval to do that. If you are considering pre-approval as a quick way to enable you to start looking for properties and making bids at auctions then speak with our experienced lenders and they can get you started.

I Have Been Pre-Approved – What Does This Mean?

This means that a quick check on your serviceability of a loan has been done and it is calculated that you should be able to make mortgage repayments on the amount you have been pre-approved for. However, it is not binding and cannot be used to make an offer on a property. It is essential to get a full or unconditional approval before proceeding with any property purchase. This involves completing a home loan application and providing all the necessary supporting documentation. (See our home loan application checklist)

Conditional approval, pre-approval and approval-in-principle are all terms that, essentially, describe the same thing. It can be a little bit confusing since all three terms will mean slightly different things to different lenders. But in essence, these three terms are used to describe an enquiry by a lender into your financial situation ahead of time.

Typically, this enquiry will happen before you even begin your house hunt. The great thing about conditional approval is that a lender will be able to give you a clear picture of what your home loan situation looks like: What you can afford, what your budget should be and more.

This prevents you from getting overzealous and house-hunting way outside of your budget. But in addition to that, conditional approval shows agents, vendors and lenders that you’re a serious prospect. Many homeowners at auction are merely investigating the market and not looking to buy. Conditional approval is a great way to demonstrate that you’re not in that category.

When should you apply for conditional approval?

Applying for conditional approval demonstrates a propensity for smart planning. It’s part of a complete finance strategy when it comes to securing a property. If you like to plan, you can apply for conditional approval after the following preparation has been done:

- Using financial tools, you’ve worked out your borrowing potential

- You know what monthly repayments you can afford

- You’re aware of different kinds of home loans and which one is right for you

- You have some understanding of the local property market

Is conditional approval all I need to get a home loan for a property?

If you go to auction with conditional approval, you’ll still need to gain full approval after a successful bid. That process will involve a valuation of the property you plan to purchase. If you’re buying privately, you can still put in an offer as long as the seller allows it.