Increase your cash flow by claiming this hidden deduction

A major drawcard of owning an income generating investment property is the significant taxation benefits that owners are able to claim.

Of all the tax deductions available to property investors, depreciation is often the most overlooked. However, this ‘hidden’ deduction is one of the easiest ways for investors to increase their cash flow now and for years to come.

According to Bradley Beer, the Chief Executive Officer of BMT Tax Depreciation, a staggering 80 per cent of property investors fail to take advantage of property depreciation and are missing out on thousands of dollars in their pockets.

“On average, most property investors can claim between $5,000 and $10,000 in depreciation deductions in the first year for a residential investment property. By simply requesting a tax depreciation schedule from a specialist Quantity Surveyor, an investor may be able to turn a negative cash flow investment into a positively geared asset,” Mr Beer said.

So what is depreciation, and more importantly, how much of a difference can claiming it make to an investor’s available cash flow?

Depreciation is a non-cash deduction that The Australian Taxation Office (ATO) allows any owner of an income producing property to claim due to the wear and tear of a building structure and its fixtures over time.

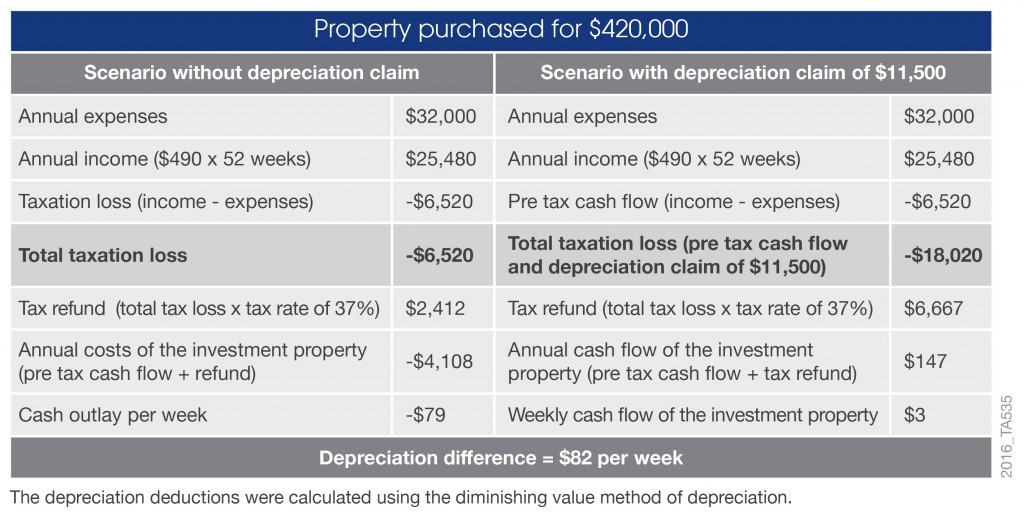

The below example highlights the returns an investment property owner can make simply by claiming depreciation.

An investor purchased a property for $420,000 and rented the property for a twelve month period for $490 per week or a total income of $25,480 per annum. Expenses for their property including interest, rates and management fees totalled to $32,000 per annum.

The following table is a summary of their cash flow situation with and without a depreciation claim of $11,500.

This investor used property depreciation to turn their negative cash flow position into a positive one.

Without depreciation they were paying out $79 per week. By taking advantage of tax legislation and making a depreciation claim, the investor was able to turn their loss to an income of $3 per week.

Looking at the bigger picture, the initial $2,412 tax loss changed to $6,667 generating a greater tax refund, saving this investor a total of $4,255 in just one year.

For an estimate of what deductions you can claim on your investment property, visit BMT Tax Depreciation’s Tax Depreciation Calculator, or for obligation free advice, call their expert team on 1300 728 726.

Article provided by BMT Tax Depreciation.

Bradley Beer (B. Con. Mgt, AAIQS, MRICS, AVAA) is the Chief Executive Officer of BMT Tax Depreciation.

Please contact 1300 728 726 or visit www.bmtqs.com.au for an Australia-wide service.