How to find the right investment property for you

Investing in property is exciting. Though, we have to remind ourselves that it’s a very different journey than buying a first home. You don’t want to buy just anything; it’s a balance of location, local facilities, price, accessibility and more. Here, we take away some of the guesswork and address the common questions around finding and buying the right investment property that suits your goals and needs.

Define your goals

Guard yourself against jumping into property investment and making things up as you go. A common frustration with first-time investors is that they don’t have clear goals. They run into hurdles that could otherwise be preventable with a little pre-planning.

Ask yourself:

- Do I want a long-term investment that I can use as my retirement nest egg?

- Am I buying a ‘fixer-upper’ so I can spruce it up with renovations and then sell it for a profit?

- Am I looking to negatively gear the investment property in the estimation that it will appreciate over time?

- Do I want to positively gear the investment property and use the profit as an extra source of income?

Having a clear goal is crucial because it defines your steps moving forward. It determines the type of property you’ll invest in, as well as location and price you’ll settle on. Knowing your goals also helps lenders give you practical advice that can further bolster your investment strategy.

Understand cash flow

Most first-time investors make the mistake of buying an investment property while still being confused about cash flow. Understanding cash flow can be the difference between a solid long-term investment and a costly mistake.

Cash flow is simply the total amount of money coming in and out of an account. Not having enough cash flow can result in negative gearing, while having a surplus of cash flow results in positive gearing.

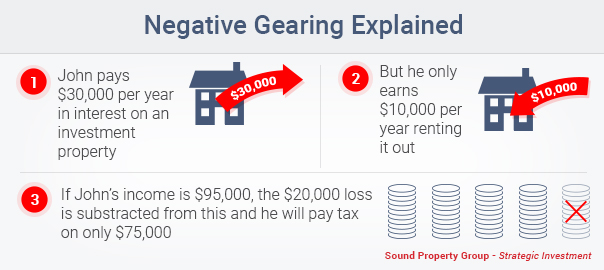

Negative gearing

Investment properties will often generate a loss, also known as negative gearing or negative cash flow. Negative gearing can work for you in two situations: 1) you expect the investment property to increase in value over time, and 2) You can use negative gearing to lower your tax.

The key takeaway: Always crunch the number before you buy. That way you know what to expect, and you won’t be left puzzled; wondering why your cash flow is drying up.

Positive gearing

While negative gearing allows investors to get into the property market sooner; when you crunch the numbers, positive gearing is the most profitable way to go. Positive gearing occurs when you borrow money for your investment, and the return covers your interest and expenses. It provides ongoing income and generates a capital gain.

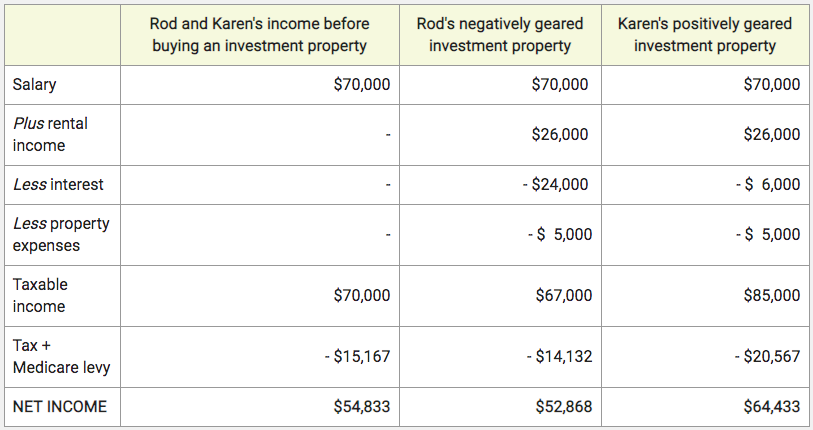

Here is an example of the proposed net income on a $400,000 property showing negative versus positive gearing investment strategies from ASIC:

In this example, Karen is being taxed more but ends up with more money in her pocket than Rod due to positive gearing. Rod’s investment is negatively geared. He has to supplement his property costs with his income, in the estimation that his property value will increase in the future and cover his early losses.

Think about location

Location plays a big part in whether your property will generate capital gains. Look into areas with a high or steadily growing rental demand. Check that there are facilities and services available like access to transport, schools, community centres, shopping centres, local businesses, parks and more. Investigate whether there will be upcoming developments for local businesses, infrastructure and facilities. Areas that are developing and expanding tend to generate more capital growth for investors.

Once you’ve done your research, settle on a few attractive locations, and further investigate to see if they have a history of growth and development. You can contact Mortgage House to receive a free property report and get some early advice from a lending specialist, making your investment research seamless.

Know what your tenants want

What does your ideal tenant look like? What’s their lifestyle like, and how will your property suit their needs? Asking targeted questions is a helpful thought experiment that gets you away from thinking about what you want and closer to what your tenant wants. After all, you want them to jump at the opportunity to rent your property, and depending on your goals, you want to keep them happy so they’ll stay there as long as possible.

Consider a couple with two kids. They’ll want extra bedrooms, perhaps a garden and a larger living area. They’ll want access to transport, schools and parks. They’ll likely want a two-car spot driveway with a garage. This will differ from a university student who’ll likely want a secure apartment close to transport, shopping centres and bars. They’re likely not to be fussed about having a car spot, or whether there are parks and community centres nearby.

Get more insights with a lending specialist

At Mortgage House, we’re no strangers to the homeowner’s journey. It’s a long (but rewarding) one.

But don’t worry, we can help with that.

If you’re thinking of investing in property, you can contact us for advice about the best options for you when it comes to your mortgage. The cost of your mortgage can drastically affect your financial planning, so it pays to speak to the experts about it.