A Gold Mine in Your Own Backyard

No longer just for grannies!

Increasing property and rental prices have forced many Australians to start looking for alternative living arrangements. This has caused a surge in demand for secondary dwellings or granny flats.

In response to this demand, data collected from thousands of BMT Tax Depreciation Schedules suggests construction of granny flats has increased by 24.1 per cent in Western Sydney suburbs and 9.3 per cent across Australia over the last two financial years. This dramatic increase in construction can be attributed to state-level legislative changes regarding secondary dwellings, aiming to boost housing affordability in capital city areas.

2009 saw the Affordable Rental Housing – State Environmental Planning Policy (SEPP) come into force in NSW. In August 2013, WA followed suit with its State Planning Policy 3.1 Residential Design Codes. With these legislative changes, NSW and WA join the NT, ACT and TAS in allowing property owners to rent a secondary dwelling to those other than family members or friends.

While renters are often attracted to granny flats for their affordability, many property investors are keen to capitalise on this recent demand for secondary dwellings due to the high rental yields often achieved.

Our data suggests that on average a granny flat will cost $121,000 to construct. Property owners have found that they are usually able to achieve annual rental yields of 15 per cent on this investment.

In order to maximise the benefit of this yield, all granny flat owners should understand their depreciation entitlements.

When a secondary dwelling is income-producing the owner is entitled to substantial deductions, even if they are currently occupying the primary residence on the property.

Research conducted by BMT has shown that the average first year depreciation deduction for a granny flat is $5,288, accumulating to $23,713 in deductions over the first five years. Shared areas between the granny flat and owner-occupied property such as patios, pools and barbecues may also entitle the owner to additional depreciation deductions, claimed based on the tenant’s usage percentage.

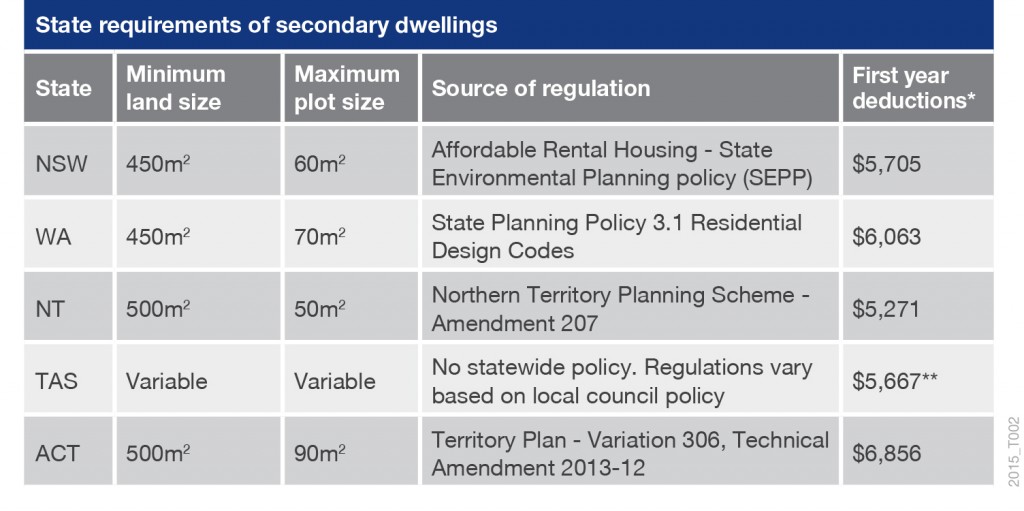

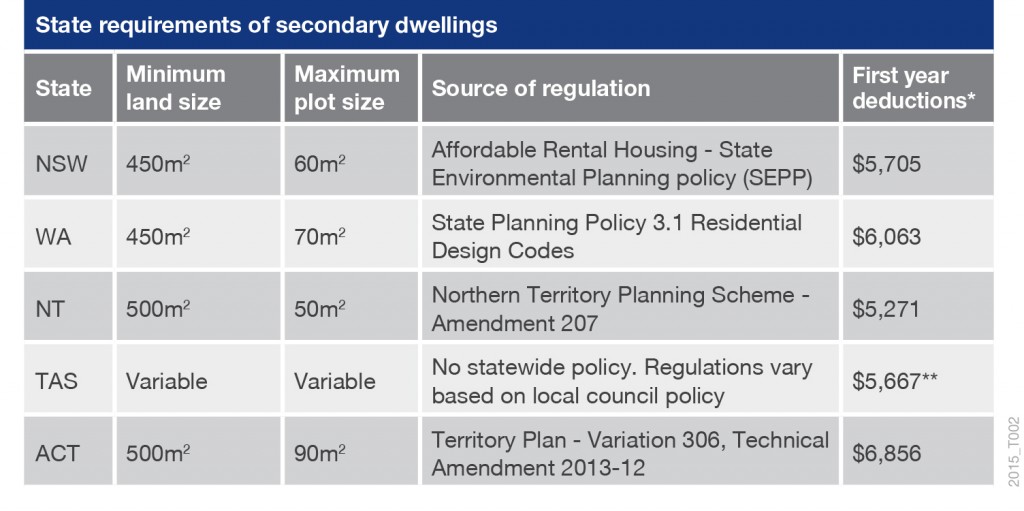

To understand the viability of using a secondary dwelling as an additional source of income on a particular property, the table below illustrates the differences in regulations between states as well as the first-year depreciation deductions a property investor would be able to claim.

*The first year deductions in this example are based on an average claim for a property of this size.

** Deductions based on a 60m2 plot size.

***In QLD, VIC and SA granny flats cannot be used as income producing secondary dwellings.

When evaluating the cash flow potential of a secondary dwelling on your property, BMT can be contacted to provide an estimate of the tax depreciation deductions that would become available.

To arrange an estimate today click here or contact the expert team at BMT on 1300 728 726.

Article provided by BMT Tax Depreciation.

Bradley Beer (B. Con. Mgt, AAIQS, MRICS, AVAA) is the Chief Executive Officer of BMT Tax Depreciation.

Please contact 1300 728 726 or visit www.bmtqs.com.au for an Australia wide service.