First homebuyer freebies

First homebuyers rejoiced in October when Kevin Rudd announced that the First Home Owner Grant (FHOG) would double to $14,000 for established homes – and treble to $21,000 for brand new properties. These federal grants are available in addition to state government grants and stamp duty incentives – so a homebuyer can now access up to $40,000 worth of government funding to help them achieve their dream. Read on to see how well your state stacks up

NSW

The First Home Plus scheme gives exemptions or concessions on stamp duty for first homebuyers, including vacant land on which you plan to build your home. Eligible purchasers pay no stamp or transfer duty on properties valued at up to $500,000, and only a concessional amount on homes of $500,000- 600,000. On a $250,000 house, this is a saving of $7,240; on Sydney a $500,000 one, the saving is $17,990. The state government recently announced an additional $3,000 to first homebuyers building a new home at a value of up to $750,000.

Savings on a $400,000 established home |

|

| FHOG | $14,000 |

| Stamp duty concession | $13,490 |

Total savings = $27,490 |

|

Savings on a $400,000 new home |

|

| FHOG | $21,000 |

| NSW government grant | $3,000 |

| Stamp duty concession | $13,490 |

Total savings = $37,490 |

Property value |

Rate of duty |

| $0-14,000 | $1.25 for every $100 or part of the dutiable value |

| $14,001-30,000 | $175 plus $1.50 for every $100 or part , by which the dutiable value exceeds $14,000 |

| $30,001-80,000 | $415 plus $1.75 for every $100 or part, by which the dutiable value exceeds $30,000 |

| $80,001-300,000 | $1,290 plus $3.50 for every $100 or part, by which the dutiable value exceeds $80,000 |

| $300,001-1,000,000 | $8,990 plus $4.50 for every $100 or part, by which the dutiable value exceeds $300,000 |

| Over $1,000,000 | $40,490 plus $5.50 for every $100 or part, by which the dutiable value exceeds $1,000,000 |

Queensland

First homebuyers in Queensland pay no stamp duty on any property valued at up to $504,999. For homes priced between $505,000 and $550,000, a concession of $875 to $7,875 is available, depending on purchase price. On a $250,000 house, the saving is $2,500; on a $500,000 house, the saving is $8,750.

Savings on a $400,000 established home |

|

| FHOG | $14,000 |

| Stamp duty concession | $5,250 |

Total savings = $19,250 |

|

Savings on a $400,000 new home |

|

| FHOG | $21,000 |

| Stamp duty concession | $13,490 |

Total savings = $26,250 |

Property value |

Rate of duty |

| Up to $350,000 | $1.00 for each $100 or part of $100 |

| $350,001-540,000 | $3,500 + $3.50 for every $100 or part of $100 over $350,000 |

| $540,001-980,000 | $10,150 + $4.50 for every $100 or part of $100 over $540,000 |

| Over $980,000 | $29,950 + $5.25 for every $100 or part of $100 over $980,0000 |

www.osr.qld.gov.au

Tasmania

First homebuyers in Tasmania can access the Duty Concession. When purchasing established dwellings, a concession of up to $4,000 is available on stamp duty for properties prices of $350,000 and under.

For the purchase of vacant land on which to build your first home, the maximum concession is $2,400, provided the purchase price of the vacant land is $175,000 or less.

Stamp/transfer duty on a $250,000 property would normally be $7,550, but this is reduced to $3,550.

Savings on a $400,000 established home |

|

| FHOG | $14,000 |

| Stamp duty concession | $0 |

Total savings = $14,000 |

|

Savings on a $400,000 new home |

|

| FHOG | $21,000 |

| Stamp duty concession | $21,000 |

Total savings = $21,000 |

Property value |

Rate of duty |

| Not more than $1,300 | $20 |

| More than $1,300 but not more than $10,000 | $1.50 for every $100 or part of dutiable value |

| More than $10,000 but not more than $30,000 | $150 + $2 for every $100 or part by which dutiable value exceeds $10,00 |

| More than $30,000 but not more than $75,000 | $550 + $2.50 for every $100 or part by which dutiable value exceeds $30,000 |

| More than $75,000 but not more than $150,000 | $1,675 + $3 for every $100 or part by which dutiable value exceeds $75 000 |

| More than $150,000 but not more than $225,000 | $3,925 + $3.50 for every $100 or part by which dutiable value exceeds $150,000 |

| More than $225,000 | $6 550 + $4 for every $100 or part by which dutiable value exceeds $225,000 |

www.treasury.tas.gov.au

SA

The First Home Bonus Grant is an additional payment for first homebuyers who qualify for the FHOG, when the market value of the property does not exceed $450,000. A one-off grant of $4,000 is available for properties valued at up to $400,000, decreasing by $8 for every $100 for properties priced between $400,000 and $450,000.

Savings on a $400,000 established home |

|

| FHOG | $14,000 |

| Stamp duty concession | $4,000 |

Total savings = $18,000 |

|

Savings on a $400,000 new home |

|

| FHOG | $21,000 |

| Stamp duty concession | $25,000 |

Total savings = $21,000 |

Property value |

Rate of duty |

| Up to $11,999 | $1.00 for every $100 or part of $100 |

| $12,000-29,999 | $120 + $2.00 for every $100 or part of $100 over $12,0 |

| $30,000-49,999 | $480 + $3.00 for every $100 or part of $100 over $30,000 |

| $50,000-99,9990 | $1,080 + $3.50 for every $100 or part of $100 over $50,000 |

| $100,000-199,999 | $2,830 + $4.00 for every $100 or part of $100 over $100,000 |

| $200,000-249,999 | $6,830 + $4.25 for every $100 or part of $100 over $200,000 |

| $250,000-299,999 | $8,955 + $4.75 for every $100 or part of $100 over $250,000 |

| $300,000-499,999 | $11,330 + $5.00 for every $100 or part of $100 over $300,000 |

| $500,000 and above | $21,330 + $5.50 for every $100 or part of $100 over $500,000 |

www.revenuesa.sa.gov.au

WA

When a homebuyer is eligible for the FHOG in WA, a concessional rate of transfer duty will apply. The First Home Owner Rate reduces the amount of stamp duty payable to nil for properties valued at up to $500,000, with a rate of $22.51 per $100 or part thereof for any amount over $500,000, up to a maximum of $600,000.

On a $250,000 property, this represents a saving of $6,935; on a $500,000 property, the saving is $17,765.

For vacant land, the rate is nil up to $300,000, and $13.01 per $100 or part there of between $300,000 and $400,000.

Savings on a $400,000 established home |

|

| FHOG | $14,000 |

| Stamp duty concession | $13,015 |

Total savings = $27,015 |

|

Savings on a $400,000 new home |

|

| FHOG | $21,000 |

| Stamp duty concession | $13,015 |

Total savings = $34,015 |

Property value |

Rate of duty |

| $0 – $120,000 | $1.90 per $100 or part thereof |

| $120,001 – $150,000 | $2,280 + $2.85 per $100 or part thereof above $120,000 |

| $150,001 – $360,000 | $3,135 + $3.80 per $100 or part thereof above $150,000 |

| $360,001 – $725,000 | $11,115 + $4.75 per $100 or part thereof above $360,000 |

| $725,001 and upwards | $28,453 + $5.15 per $100 or part thereof above $725,000 |

www.dtf.wa.gov.au

ACT

The Home Buyer Concession Scheme provides first homebuyers with a stamp duty concession on all properties valued under $412,000. The minimum duty payable is $20 on any property valued at up to $333,000. A rate of $19.80 per $100 or part thereof is payable for any amount over $333,000, up to a maximum of $412,000. On a $250,000 property, this represents a saving of $7,500.

To be eligible for a duty concession, you must satisfy an income test.

For more information, go to www.revenue.act.gov.au

Savings on a $400,000 established home |

|

| FHOG | $14,000 |

| Stamp duty concession | $15,000 |

Total savings = $29,000 |

|

Savings on a $400,000 new home |

|

| FHOG | $21,000 |

| Stamp duty concession | $15,000 |

Total savings = $36,000 |

Property value |

Rate of duty |

| $100,000 and under | $20 or $2.00 per $100 or part thereof, whichever is greater |

| $100,001-200,000 | $2,000 + $3.50 per $100 or part thereof by which the value exceeds $100,000 |

| $200,001-300,000 | $5,500 + $4.00 per $100 or part thereof by which the value exceeds $200,000 |

| $300,001-500,000 | $9,500 + $5.50 per $100 or part thereof by which the value exceeds $300,000 |

| $500,001-1,000,000 | $20,500 + $5.75 per $100 or part thereof by which the value exceeds $500,000 |

| $1,000,001 and over | $49,250 + $6.75 per $100 or part thereof by which the value exceeds $1,000,000 |

www.revenue.act.gov.au

Victoria

First homebuyers who qualify for the FHOG can also receive the First Home Bonus (FHB) if the property value does not exceed $500,000. The FHB gives $3,000 for purchasing an established home, and $5,000 for a brand new home. If you build or buy a new home in regional Victoria, you receive an extra $3,000. Stamp duty concessions and exemptions are also available to first homebuyers who have families with dependent children. However, buyers must chose between this or the FHB. The FHB provides more savings on all properties that cost more than $200,000.

To be eligible for a duty concession, you must satisfy an income test.

For more information, go to www.revenue.act.gov.au

Savings on a $400,000 established home |

|

| FHOG | $14,000 |

| First home bonus | $3,000 |

| Stamp duty concession | $0 |

Total savings = $17,000 |

|

Savings on a $400,000 new home |

|

| FHOG | $21,000 |

| First home bonus | $5,000 |

| Regional first home bonus | $3,000 |

| Stamp duty concession | $0 |

Total savings = $29,000 |

Property value |

Rate of duty |

| $0-25,000 | 1.4% of the dutiable value of the property |

| $25,001-130,000 | $350 + 2.4% of the dutiable value in excess of $25,000 |

| $130,001-440,000 | $2,870 + 5% of the dutiable value in excess of $130,000 |

| $440,001-550,000 | $18,370 + 6% of the dutiable value in excess of $440,000 |

| $550,001-960,000 | $28,070 + 6% of the dutiable value in excess of $550,000 |

| Over $960,000 | 5.5% of the dutiable value |

www.sro.vic.gov.au

NT

First homebuyers are entitled to an exemption on stamp duty for properties valued at up to $385,000. This gives a saving of $7,857 on a $250,000 home, and a saving of $15,515 on a $385,000 home.

For any property purchase valued at more than $385,000, first homebuyers are not entitled to any concession on stamp duty.

Savings on a $400,000 established home |

|

| FHOG | $14,000 |

| Stamp duty concession | $0 |

Total savings = $14,000 |

|

Savings on a $400,000 new home |

|

| FHOG | $21,000 |

| Stamp duty concession | $0 |

Total savings = $21,000 |

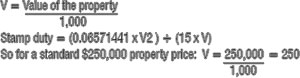

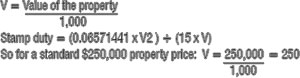

PPOR stamp duty rates |

|

| The formula to work out the stamp duty payable is complex: | |

|

|

Stamp duty |

= (0.06571441 x V2 ) + (15 x V) |

| = (0.06571441 x [250 x 250] + (15 x 250) | |

| = (0.06571441 x 62,500) + 3,750 | |

| = $4,107.15 + $3,750 | |

| = $7,857.15 | |

| Where the dutiable value exceeds $525,000 – 4.95% of that amount |

www.nt.gov.au