The Depreciation Deductions that Often Go Unclaimed

Depreciation continues to be one of the most common deductions missed as research suggests that just 20 per cent of property investors maximise the deductions they can claim.

On average, an income producing property owner can expect to claim between $5,000 and $10,000 in depreciation deductions in the first financial year alone. These deductions play a vital role in helping property investors to improve their available cash flow and reduce the costs of holding a property.

With such high numbers failing to maximise depreciation, investors often ask what items are most often missed or are rarely claimed to avoid missing out on deductions in the future.

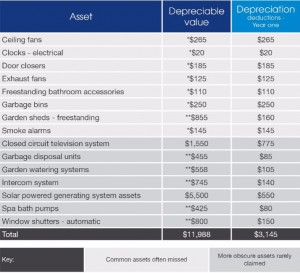

To assist investors, BMT Tax Depreciation compiled a list of common assets missed and more obscure assets rarely claimed, as shown below.

The depreciation deductions within this table have been based on the diminishing value method of depreciation and are based on a first full financial year’s claim.

*Assets which have a depreciation value of $300 or less can be written off as an immediate write-off in the first full financial year’s claim.

**Those assets which have a value of $1,000 or less can be added to a low-value pool and depreciated at a rate of 18.75 per cent in the first year.

As the table shows, ceiling fans, door closers, garbage bins, smoke alarms and freestanding garden sheds are some of the assets commonly missed by property investors.

More obscure and less frequently found items that are rarely claimed included closed circuit television systems (CCTV), intercom systems, garden watering systems and spa bath pumps.

While many of the items in the table have a low depreciable value, the depreciation deductions for these items can add up to thousands of dollars for an investor.

To ensure that depreciation is maximised, it is recommended that investors seek advice and obtain a tax depreciation schedule from a specialist Quantity Surveyor.

This will include a detailed site inspection of the property to photograph and note every depreciable asset found in the property. The Quantity Surveyor will then use their expert knowledge of depreciation and utilise methods such as immediate write-offs and low-value pooling to maximise the deductions that can be claimed for the investment property owner.

All of the deductions a property investor is eligible to claim will be outlined in a comprehensive depreciation schedule in a format that they or their Accountant can easily follow and claim the depreciation benefits when they complete their annual income tax return.

To find out more about the depreciation deductions available for any income producing property, investors can contact the expert team at BMT Tax Depreciation on 1300 728 726 for obligation free advice.

Article provided by BMT Tax Depreciation.

Bradley Beer (B. Con. Mgt, AAIQS, MRICS, AVAA) is the Chief Executive Officer of BMT Tax Depreciation.

Please contact 1300 728 726 or visit www.bmtqs.com.au for an Australia-wide service.