How to beat the 6 enemies of saving money

Trying to save money can feel like you’re trying to catch air in a Haitian sack – and truth be told, without a system, it may as well be.

Saving is hard for everybody. That’s why it’s important to create a savings habit as soon as possible because your savings take care of themselves.

The 6 enemies of saving money

- Making ad-hock decisions around how much you’re going to save every pay cycle

- Your savings are too accessible

- You’re saving the hard way, not smart the smart way

- You don’t have a savings goal

- You don’t reward yourself

- You don’t have an emergency fund

Making ad-hock decisions around how much you’re going to save every pay cycle

If you’re deciding how much you’re willing to save each month, you’re setting yourself up for disappointment. It’s because we’re all human, and we have a finite amount of willpower. Relying on ourselves to consistently make good decisions around saving is unrealistic. There are too many variables that are unaccounted for, like having a tough day, a headache, a flat tyre…and more.

The best bet is to not make decisions. Well, make one good decision and just automate it to recur every month. It’s like you’re locking in a good decision that’s going to keep paying you back in savings.

Your savings are too accessible

It’s fantastic to have your savings automated and being taken care of in the background. But, it’s no good if you’re growing your savings and then constantly dipping into them. That is a slow death, and worst of all, you’re setting yourself up for disappointment. The best thing to do is make it hard for yourself to easily access your precious savings. You can either use a separate banking institution, a term deposit or put your savings straight into your super account. Restricting your access to your savings where possible is a good thing.

You’re saving the hard way, not smart the smart way

When it comes to saving and budgeting, the simpler the steps the better. Yes, it’s true that you do need to get into the granular details of your cash flow so you can understand where your money is going…but when it comes to practically living with your budget – the simpler, the better.

A good way to determine what should be included in your budget if you say ‘heck yes’ to something. If your response is anything less than a ‘heck yes’, you have to make a commitment to ruthlessly cut that thing out of your expense list. Yes, this is uncomfortable at first, but after a short time, you’ll adjust and build momentum, and then you’ll be able to know in a split second what is worthwhile spending on versus what isn’t.

You don’t have a savings goal

Everyone knows it’s important to save money. But, not many know why they’re saving money. There are obvious things like buying a house, holidays, renovations, new stuff and more.

But what about the deeper emotional reasons to save money?

- Confidence about your future

- Financial safety and security

- The privilege of having options

- The ability to provide for loved ones

- Happiness at the prospect of retiring with all your needs accounted for

If you want your savings goal to stick, it’s wise to tie it to an emotion, because emotions are the reasons we do everything.

You don’t reward yourself

Here’s one step that people tend to forget about. Rewarding yourself when you’ve stuck to a goal and achieved something is imperative. Especially if you want to keep motivating yourself to stay on track.

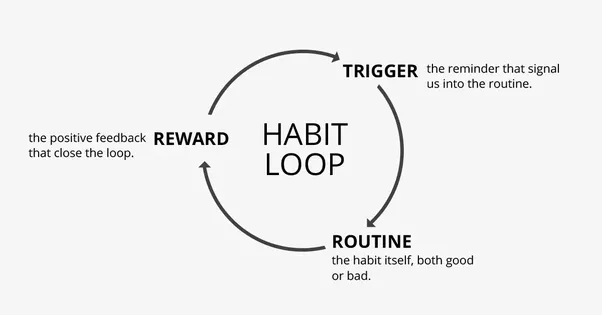

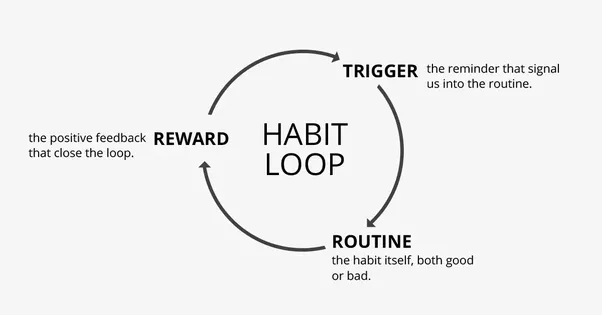

In the famous ‘Habit Loop’ proposed by Charles Duhigg, the reward is an important part of the habit-forming process.

The point of reward is to reinforce the behaviour you want to repeat. When you reward yourself, you boost your motivation to restart your positive behaviour. So, don’t skip out on rewarding yourself when you hit a savings goal – it’s very important to celebrate.

You don’t have an emergency fund

An emergency fund is a buffer between the unexpected events of life and your savings account. It protects your savings and lets you get out of the prickly situations life will inevitably throw at you. It’s also very practical because your savings account will either sit with another lender, or it will be hard to access, so when there’s an event that requires you to have cash right away, you’re going to need an emergency fund. One study found that 43% of Australians don’t save at all. This is devastating to consider when the car tire blows, or the fridge gives out, or worse, there’s an unexpected loss of a job. Not having an emergency or savings account makes bad situations worse.

Mortgage House

At Mortgage House, we’re no strangers to helping you become a property investor. It can be a long journey, but it’s a rewarding one. If you’re thinking of investing in property, you can contact us for information about the best options for you when it comes to home loans.