What does LVR mean for my home loan?

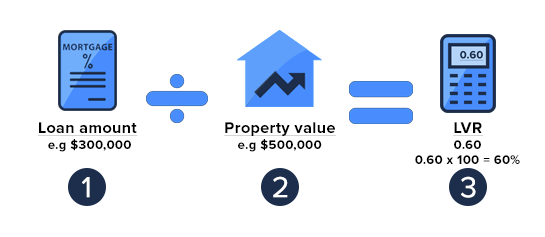

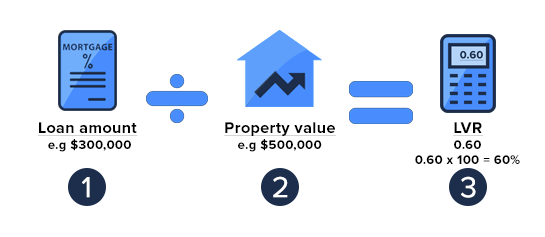

What is the LVR formula and how does it work?

LVR stands for loan-to-value ratio and it can be an important calculation to understand when you are buying a property. LVR is an equation to represent the amount you are borrowing compared to the value of the property you are looking to buy. Most banks and lenders won’t lend 100% of the value if you are buying a property and understanding what your maximum LVR is can be important. If the property is worth $1 million and you have a maximum deposit of $200,000, then your LVR is 80%. The rest of the home loan will be made up of your deposit. Some banks and lenders may allow a higher LVR, however that can attract higher interest rates and maybe higher fees and charges, to help manage potential risk. Understanding your maximum deposit means it is easy to calculate the maximum LVR you are looking for, if you already have your eye on a home. However, some banks and lenders may require a larger deposit, especially if you have a low credit score.

How can I put LVR into a loan calculator?

At Mortgage House, we want our customers to have access to the best tools and information available, to make finding a suitable loan simpler when buying a property. One of those resources is our Mortgage Repayment Calculator. This calculator can help give you an understanding of how much your repayments may be when you take out a loan. By entering the information as accurately as possible, you’ll also gain an understanding of what each repayment will be made up of (interest and principal) and how much interest you will pay over the life of the loan. If you are considering a larger deposit, then shrink the loan amount accordingly and see how that changes both the repayment and interest amounts. Adjust based on different LVR options to see how they will affect your budget.

Calculator

Important Disclaimer: This is intended as a guide only. Details of terms and conditions, interest rates, fees and charges are available upon application. Mortgage House’s prevailing credit criteria apply. Please note that your actual fortnightly repayment would be equal to the monthly repayment amount divided by two. Weekly repayments would equal the monthly repayment amount divided by four. If you choose to pay fortnightly or weekly, your actual repayments will be higher than repayments shown on this page. You can reduce the term of your loan if you choose to make repayments fortnightly or weekly. We recommend you seek independent legal and financial advice before proceeding with any loan.

How can LVR impact buying an Investment property?

For those looking to invest, buying a property can be a lucrative decision. Not only do you get the regular income of tenants and potentially a profit when you sell, but you can also benefit from a range of different tax incentives. Understanding LVR can help you use the equity in your current home as part of a larger deposit for an investment property. Firstly, calculate the equity you have in your home. Equity is the difference between the current market value of your home and the amount you still owe on it. If you owe $300,000 on your current home mortgage and your property is valued at $1,000,000, then you have $700,000 equity in your home. To see how much equity you could get to buy an investment property, multiply your property value by 80%, which is a common LVR. Then, minus the amount you still owe on the property. This provides you with the amount of equity you can put towards your investment property. In the case above, having equity of $700,000 on a $1,000,000 home can give you $300,000 to put towards an investment property.

Does LVR change with comparison rate?

LVR doesn’t change with a Comparison Rate. A Comparison Rate is a tool banks and lenders use, by law, to give those buying a property an opportunity to compare types of loans fairly. There are two main types of mortgages:

- Variable Rate. Loans with a variable interest rate mean your interest rate can increase or decrease over the life of the loan, depending on a range of internal and external factors.

- Fixed Rate. With fixed rate mortgages, your interest rate will stay the same for an agreed period, usually between 1 and 5 years.

Comparison Rates take into account fees and charges of home loans, to make it easier to compare mortgages of all kinds.

Does LVR affect the amount of stamp duty I pay?

LVR doesn’t affect the amount of stamp duty you will pay when you are buying a property, but it is important to keep it in mind when calculating how much you need to borrow when you are making a home loan application. Stamp duty is a tax or levy on the transaction of buying a property. How much you pay depends on which state you live in and, sometimes, whether or not you are building a home or are a first-home buyer. When buying a property, include the likely cost of stamp duty in your loan calculations. Adding stamp duty to your loan may only slightly adjust the LVR calculation.

Calculator

If I have a lower LVR, is that better for my loan application?

When it comes to buying a property, the lower the LVR you have, the less banks and lenders are likely to see you as a risk. So, yes, a lower LVR can be beneficial, as can having a larger deposit. There are some banks and lenders who may offer you a home loan with a LVR that is higher than 80%, however be aware of any extra fees or charges the loan may incur as a result. Another thing that can help in this area when you are buying a property, especially if you don’t have a larger deposit, is Lenders Mortgage Insurance (LMI). LMI can protect the lender in case the borrower defaults on their mortgage. The Reserve Bank has predicted that up to 25% of Australian mortgages are protected with LMI. LMI can help push your LVR above 80%, meaning you may need a smaller deposit. LMI is calculated on the loan amount, and the cost of it can also depend on your own individual financial circumstances. Generally, a smaller deposit can mean a more expensive LMI premium. Banks and lenders organise LMI for you and may therefore offer you differing rates. The amount you pay for LMI can also be dependent on the type of loan you are looking for when you are buying a property.