What is a family pledge loan and how does it work?

Getting started in today’s property market can be tough. Every little bit can help, and a family pledge can go a long way to helping you choose from the mortgages you need to make your property dreams a reality. Family Pledge mortgages can allow you to borrow the full value of your desired property, using a percentage of the value of the residential real estate of an immediate family member.

What are the advantages of a Family Pledge?

While the benefits of a Family Pledge loan can be obvious, there are some little-known advantages of these mortgages, including:

- No deposit. With a guarantor to back you, you won’t have to save for a deposit, something most banks or lenders require with modern mortgages.

- You may borrow more. Depending on how much your guarantor is prepared to pledge, you may be able to borrow 100% of the purchase price of your property, or even 110% to help you cover the costs of buying a home.

- Redraw or refinance. Most Family Pledge loans allow you to redraw money, or refinance your home loan, when you have enough equity in your home or when you have made enough extra repayments or lump sum payments. You can use this money to free the guarantor from your mortgage.

How much can I borrow?

At Mortgage House, we understand the importance of giving would-be home buyers access to the tools and resources they tell us they need. One of these tools is our borrowing calculator. A borrowing calculator allows you to get an indication of how much you may be able to borrow if your home loan is approved. All you need to do is enter in all the information as accurately as you can, and receive a result. It is not approval for a loan, or even pre-approval, but as an indication it can help you narrow down your property search. Make sure you include the amount your family member is prepared to guarantee.

Borrowing Calculator

Important Disclaimer: This is intended as a guide only. Details of terms and conditions, interest rates, fees and charges are available upon application. Mortgage House's prevailing credit criteria apply. We recommend you seek independent legal and financial advice before proceeding with any loan. The Comparison Rate for each of the home loan products contained in this page is based on a loan of $150,000 over a 25 year term. Fees and charges may be payable.

WARNING: The comparison rate is true only for the examples given and may not include all fees and charges. Different terms, fees or other loan amounts might result in a different comparison rate. * This mortgage calculator shows indicative repayments based on 12/26/52 equal repayments for monthly/fortnightly/weekly options.

What kinds of loans can I choose from?

If you have the appropriate level of pledge, you can choose from a large range of Mortgage House home loans, including:

- Variable Rate Home Loan. Variable rate home loans are our most popular kind of loans, especially given the current record low interest rates. These loans feature an interest rate that can increase or decrease over the life of the loan, based on both internal and external factors.

- Fixed Rate Home Loan. As they sound, fixed rate mortgages are the opposite. They feature interest rates that are fixed for an agreed period, usually between 1 and 5

- Toggle Offset Home Loan. A toggle home loan can give you the benefits of both a fixed and variable mortgage. A toggle home loan is split between both, giving you the flexibility of toggling between the two when it benefits you financially.

- Split Home Loan. A split home loan can be very similar to a toggle mortgage, but it can be even more flexible. This is because there are no restrictions on how much of your home loan is fixed and how much is variable.

- Portable Home Loan. A portable mortgage can be a good investment in the future. It allows you to take your home loan with you when you move, acknowledging that most people don’t live in the one house for the entire life of their loan.

- Principal and Interest Home Loan. The repayments of these loans are made up of both the principal amount, and interest charged. Paying back the principal at the same time as the interest allows you to make a bigger dent in your loan amount.

- Interest Only Home Loan. Interest-only home loans can help free up money for other things. Your repayments are only made up of the interest portion.

- Construction Home Loan. These kinds of mortgages are tailored to those building a home or investment property. They allow you to only pay your builder after agreed stages of the construction have been completed. Interest is only charged on the amount you have paid out, not the full loan amount.

How can I compare home loans?

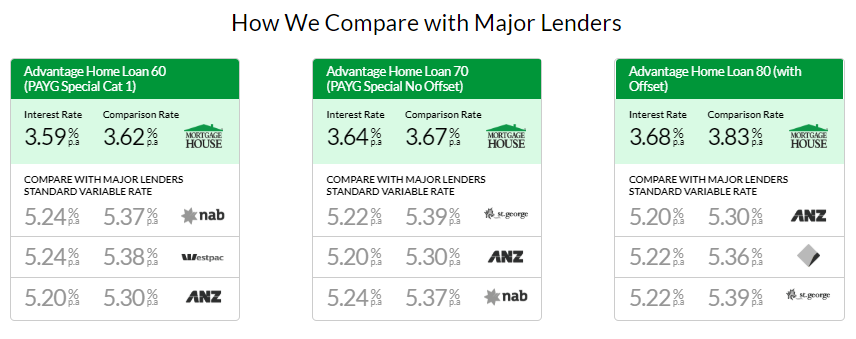

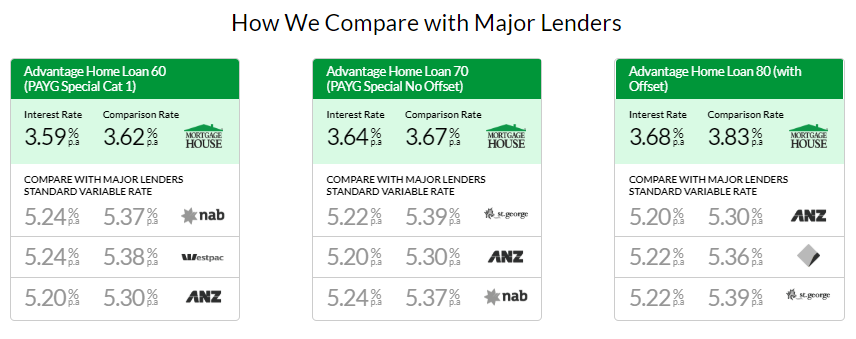

Mortgage House makes it easy to compare loans. As Australia’s largest independently owned non-bank lender, we offer a large range of loan and mortgage finance options that may be suitable for your financial needs. We have a continued focus on being competitive with our rates, offering diversity with our products and providing a level of customer service simply unheard of in the industry. You can compare all our home loans here.

When you compare our home loans, remember our philosophy of providing loan, product and service outcomes tailored to your exact needs by:

- Ensuring we actively listen to our customers’ needs, not what we think their needs may be.

- Always identifying suitable loan and mortgage finance products and options for every customer.

- Guaranteeing to provide ongoing support over the whole life of the loan.

- Engaging our leading technology to create a simple and seamless process for the customer.

- Providing our customers with all the tools and knowledge that we can.

Who can be a guarantor?

Choosing your guarantor to make your family pledge can be a big decision. Firstly, there can be some risk in getting family members involved in your finances. Relationships can be strained if something goes wrong. There is, however, a number of practical things to think about when looking for a guarantor for a Family Pledge home loan, including:

- Being a close family member. Most banks and lenders prefer immediate family members to act as a guarantor for a Family Pledge loan, but make sure you check with them first.

- Having strong equity. It is important for the family member to have a strong equity stake in their property. It is that equity that the bank will use as a guarantee.

- Making sure their finances are in order. It is also important your guarantor has a strong credit rating. A poor credit rating can see banks or lenders hesitate with the application.

- Right age and right nationality. Most banks and lenders prefer Australian residents when accepting a family member as a guarantor. It can also be important for them to be under 65 and, obviously, over 18.

What will my repayments be?

With a Family Pledge home loan, you still need to show a lender you can make the repayments over the life of the loan. Once you have paid off enough of your mortgage, and have suitable equity in your new home, you can refinance your loan to allow release of the family pledge.

Repayment Calculator

Important Disclaimer: This is intended as a guide only. Details of terms and conditions, interest rates, fees and charges are available upon application. Mortgage House’s prevailing credit criteria apply. Please note that your actual fortnightly repayment would be equal to the monthly repayment amount divided by two. Weekly repayments would equal the monthly repayment amount divided by four. If you choose to pay fortnightly or weekly, your actual repayments will be higher than repayments shown on this page. You can reduce the term of your loan if you choose to make repayments fortnightly or weekly. We recommend you seek independent legal and financial advice before proceeding with any loan.

What can I use a Family Pledge home loan for?

Family Pledge home loans can be just as flexible as the rest of Mortgage House’s range, once the deposit requirements and approvals have been met. As a result, they can be used for a range of purposes, including:

- Purchasing a home. You can use a Family Pledge loan to buy a home you intend to live in.

- Investing. Having a family pledge you money can mean you can use it to invest in property. The major difference is that guarantors become jointly liable for the loan, and the amount of the guarantee cannot be limited between borrowers.

How much will my Family Pledge amount need to be?

Whether or not someone is successful with an application for a Family Pledge loan is centred around the loan-to-value ratio. In a nutshell, LVR is the ratio of the amount of risk a bank or a lender is willing to take. They will need to know that if you default on the loan they will be able to sell the house and recoup their money. LVR is a calculation. It is the amount of the loan, divided by the purchase price, or the amount of the independently determined value of the property.

So, for example, if your loan was for $400,000 and you bought the house for $500,000, then the LVR would be 80%. Banks and lenders like to keep the LVR at or below 80%. Anything higher and they may require lenders mortgage insurance, and offer you a higher interest rate. The bigger the deposit you can get, including with the family pledge, the better. A deposit of 20% can give you the 80% LVR immediately. But, don’t forget to include upfront fees and stamp duty in these calculations.

What are some of the features of Family Pledge home loans?

A suitable family pledge can help you unlock our large range of home loans, as well as the many features they include, such as:

- Offset. This feature can save you money, by allowing you to use a non-interest-bearing bank account to offset against your home loan. Interest is calculated on the difference between the two accounts, not just the mortgage.

- Additional repayments. Being able to make additional repayments without attracting a fee is another way to save money. The more repayments you make, the sooner you pay off your home loan, the less interest you pay.

- Redraw. If you do make extra repayments or lump sum payments, having this feature allows you to redraw or withdraw them whenever you want, for whatever reason. The only caveat is that your minimum repayments are up to date.

- Toggle. As mentioned above, having a toggle feature can allow you to toggle between fixed and variable interest rates to maximise your savings.

- Relocation. Some of our home loans allow you to take it with you when you move, acknowledging not a lot of people stay in the one home over the entire life of their mortgage.