Mortgage Broker North Sydney

Empowering borrowers with low-rate home loan solutions in glorious North Sydney and surrounds.

Welcome to Mortgage House North Sydney

Overlooking the Sydney Harbour Bridge, our North Sydney office is the head office of Mortgage House — a Direct Non-Bank Lender serving Australians since 1986. We help locals achieve their home ownership and investment dreams with low-rate loans, fast decisions, and ongoing support beyond settlement.

Why Choose an Direct Non-Bank Lender?

Mortgage House is a direct lender, not a broker. You deal directly with decision-makers who prioritise speed, clarity and consistency. Our North Sydney team offers tailored loan solutions using our own products, built to fit your borrowing capacity and financial goals.

Mortgage House North Sydney

Home Loans

Streamlined systems and some of the best home loan rates make Mortgage House a genuine home loan provider alternative to the major banks providing a vast category of loans including First Home Buyer Loan, Refinance Loan, Variable Rate Loans, Fixed Rate Loans and many more.

Investment Property Loans

With a growing population comes development and consolidation, making investing in real estate a potentially lucrative venture. The right investment can generate income and provide significant profit when the property value increases.

Your strategy should be backed the lowest investment loan rates to suit your goals and needs. Whether you are looking to purchase your first investment property in Australia, or are building your portfolio you should compare investment loan rates and get tailored advice from our lending specialists at Mortgage House.

Construction Loans

If you are looking to build a new house rather than purchase an existing property then a construction home loan is for you.

Once you decide that you’d like to build your dream home, we’ll help you determine if the quoted land and construction costs are reasonably priced for the area.

- Available for registered builders and owner-builders

- 24 months to complete construction after settlement

- Pay interest only on amounts drawn down

- Automatically reverts to standard variable mortgage

SMSF Loans

There is a great deal of freedom that comes from planning your financial future. A Self-Managed Super Fund is a worthwhile consideration if you want to map out your retirement funding and control where and how your superannuation is invested.

As one of Australia’s accredited SMSF lenders, the Lending Specialists at Mortgage House are experienced and here to help you navigate the government regulations seamlessly. We can easily explain the different borrowing requirements and restrictions for your SMSF property loan to ensure you achieve the best loan possible in line with your specific circumstances.

Commercial Loans

A Mortgage House commercial loan can give you a strategic advantage, supplying you with the knowledge that a shortage of funds won’t stop the growth plans of your business. Mortgage House commercial finance options can help you with:

- Property investment. Investing in commercial property can be attractive, especially if there is a shortage in a particular city, suburb or town. Commercial leases can be long-term, helping with your long-term financial stability.

- Owner-occupied premises. If you own a business, then commercial finance can help you expand and take advantage of any urgent opportunities that arise.

- Refinancing. Whether it’s a home mortgage, a business loan, or commercial finance, having a financial health check every now and again can be good practice. Refinancing may help you find a better commercial loan, with more relevant features, lower interest rates and smaller repayments. That can save your business thousands over the life of the loan.

Business Loans

Whether you’re a business owner or involved in property, the right loan can help you immediately capitalise on an opportunity.

We understand that the day-to-day of operating a small business isn’t easy.

If you need finance for anything, from an expansion opportunity down to purchasing a replacement coffee machine, we can help.

At Mortgage House, we offer flexible solutions for a variety of business loan needs including:

- Cashflow

- Growth and expansion

- Equipment purchase

Supporting You Through Life’s Milestones

From your first home to refinancing or commercial funding, Mortgage House North Sydney supports a wide range of credit profiles and security types with long-term, trusted solutions.

Direct Non-Bank Lending, Not Brokerage

We avoid the complexity of juggling multiple lenders. As an Direct Non-Bank Lender, Mortgage House prioritises consistency, speed, and a better customer experience.

Your Trusted Direct Non-Bank Lender in North Sydney

Mortgage House North Sydney is part of one of Australia’s largest Direct Non-Bank home loan lenders. We deliver direct lending outcomes without the confusion of broker networks.

Meet the North Sydney team

Our North Sydney team delivers five-star customer service through experience and local insight. From application to settlement, your Lending Specialist will keep you informed and empowered.

The Mortgage House Advantages

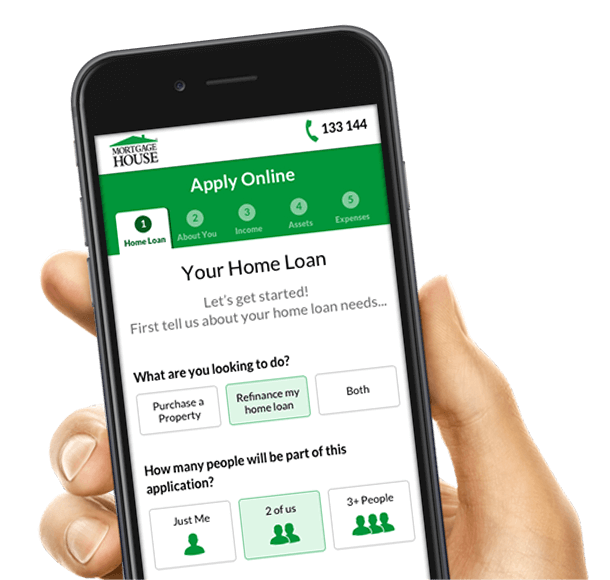

Simple Application Process

Apply online anywhere, anytime. Our digital systems offer swift approval paths and secure document upload directly into our Microsoft Azure-hosted loan origination platform.

Local Knowledge and Experience

We serve North Sydney, Crows Nest, Neutral Bay, Milsons Point and surrounds — areas we know intimately through years of lending and property insight.

Low Rate Loans

Customised low-rate products designed to reduce repayments while keeping flexibility. We compare rates across our portfolio to find the right fit for your budget.

Value-Adding Loan Features

Offset accounts, loan splitting, portability, and no monthly fees are standard in our most popular products.

Award-Winning Since 1986

Mortgage House continues to receive national recognition for service excellence and innovation in lending.

Loans that Make Sense in North Sydney

Loans for Every Type of Borrower

Home loans, SMSF loans, construction loans, refinancer loans and commercial loan solutions.

Dedicated Lending Specialists

Committed to 5-star customer service, your individual needs will be taken care of promptly and professionally.

Local Knowledge and Experience

We stay in the know about all real estate and finance market activity to give you the best borrowing advice.

Why Choose Mortgage House Home Loans?

Simple Application Process

Low Rate Loans

Save money and pay less each month with customised low rate loan products to suit your borrowing needs.

Value-adding Loan Features

Award-winning

Our Success is Your Success

We continue to achieve industry recognition for excellence in customer service and low-rate loan products. When you come to Mortgage House, know that you are in the safest hands.

WeMoney

Best Low Deposit Home Loan of the Year Back to Back Winner 2023-2024 (2 years)

ProductReview.com.au

Home Loans – 2023 Winner

Money Magazine

Best-Value Basic Home Loan

(Non-Bank) 2022

RateCity

Best Variable Home Loan

for the Chameleon Executive Home Loan 2022

Contact Mortgage House North Sydney

North Sydney

With Sydney Harbour to the south and Middle Harbour to the east, we proudly service postcodes 2000 to 2110 and beyond. Feel free to schedule a call back or book an appointment today.

Opening Hours

Monday 8am–6pm

Tuesday 8am–6pm

Wednesday 8am–6pm

Thursday 8am–6pm

Friday 8am–6pm

Saturday Closed

Sunday Closed

Location

Popular Low-Rate Loan Products

Interest Rate

6.14

%

p.a

Comparison Rate^

6.18

%

p.a

Compare with major lenders variable rates as at 02 JAN 2026 Benefits

Interest Rate

5.14

%

p.a

Comparison Rate^

5.18

%

p.a

Compare with major lenders variable rates as at 02 JAN 2026 Benefits

Interest Rate

5.19

%

p.a

Comparison Rate^

5.23

%

p.a

Compare with major lenders variable rates as at 02 JAN 2026 Benefits

What North Sydney Customers Have to Say

Quintin helped to refinance our current loan and helped set up a new purchase loan. He is very professional and knowledgeable… Thank you for the smooth processes and exceptional customer service.

Jimmy is an excellent person to deal with. Prompt responses and excellent service. I would highly recommend him.

Mortgage House Lending Specialist Quintin is very professional and experienced. They helped me through the home application process with quick approval. Thank you.

Frequently Asked Questions

Is Mortgage House a broker?

No, we are an independent lender offering direct home loans.

What loans are available?

Home, SMSF, construction, refinance and commercial.

Does Mortgage House provide SMSF loans?

Yes — we specialise in SMSF property finance under strict regulatory standards.

How do I apply?

Lending criteria apply. All applications are subject to assessment under ASIC RG 209 responsible-lending obligations.

Mortgage House is a member of AFCA (complaints 1300 931 678).

ASIC RG 234 — Advertising content verified for truthfulness and comparability; no unqualified rate claims.

ASIC RG 209 — Responsible lending disclaimer present on all product references.

AFCA and ABA Compliance — Complaint process link added to footer.

APRA CPS 234 — All customer data encrypted in transit and at rest.