Keeping our interest rates competitive is what we value greatly.

We will always strive to keep our interest rates on hold for as long as possible. However, circumstances beyond our control including inflation, rising funding costs and stricter regulations can affect the timing of when a rate increase occurs on our different loan products.

You have our commitment that we will continue to do our best to maintain your competitive rates within the market.

We understand that this may impact your budget when you’re trying to pay off your loan. While a rate change is inevitable, it gives you the opportunity to reach out to your dedicated Lending Specialist about reviewing your home loan and repayments.

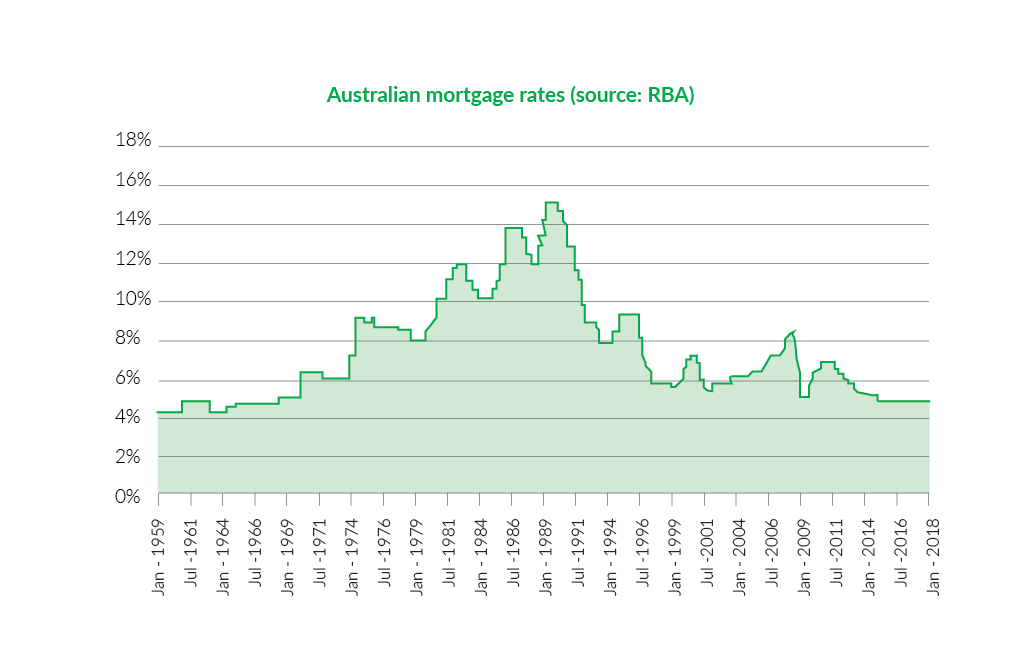

You can still make the most of your mortgage as interest rates continue to be at historical lows as compared to previous decades:

Plan ahead and future-proof your finances:

Review your family budget

To protect yourself against interest rate change, review your budget to make sure you can handle any change in repayments. The good news is that if you’ve already been making extra repayments, the difference could make up the shortfall and you won’t notice the change. Our free Budget Planner Calculator can help.

Make extra repayments if you can

Making even small extra repayments regularly can have massive long-term benefits and could future-proof you against further interest raise increases.

Talk to your dedicated Lending Specialist

It’s a good time to get a home loan Health Check, a free service where we can quickly identify areas where you may be able to:

- Improve your cash flow

- Reduce your interest rate

- Restructure debt to save money

- Reduce loan payments

- Unlock equity

- Minimise your mortgage

Consider other ways to increase your cash flow

This could be the perfect time to look at debt consolidation to save more. Combining smaller higher-interest debt like credit card balances or personal loans into your mortgage has two benefits: you can enjoy the same low rate as your home loan and convenient single monthly repayments to manage.

What are the reasons behind the rate hikes in Australia?

Funding Costs

The money lenders lend you often is a mixture of wholesale debt and deposits. Wholesale debt is the money lenders borrow at a lower rate, and then lends to borrowers. Factors such as overseas markets, competition for funding sources, RMBS, BBSW and retail deposits all affect the cost of funds for lenders.

RMBS

The Residential Mortgage-Backed Security is the group of mortgages owned by the lender which is sold as a bond to investors. This is how the lender secures the funds to create loans for new customers, however, it also incurs debt through paying back investors based on mortgage performance.

BBSW

The cost of funding has been increasing steadily, and pairing that with an unusually high BBSW (Bank Bill Swap Rate) has resulted in big funding pressures for Australian lenders.

The BBSW helps to set most variable interest rates, and is where banks borrow money from each other to cover their costs. On days when banks spend more than they bring in, they’ll borrow funds from another bank – BBSW is the interest rate on these short-term borrowings.

Retail Deposits

Retail Deposits are another factor which affects wholesale debt. The money a lender puts in a savings account or term deposit should offer higher interest rates to make it more attractive to retail customers. However, these higher interest rates lower the net interest margin on the loan.

The Reserve Bank Cash Rate (RBA)

The Reserve Bank moves the cash rate – the rate the RBA charges lenders and banks for overnight loans – to keep growth and inflation in balance.

The RBA has not moved its figure for 22 consecutive meetings, which is a record length of time. Usually, lenders are able to keep their home loan rates in line with the RBA, but other pressures which have increased funding costs mean interest rates for many lenders are rising.

Regulatory Change

Lenders in Australia are regulated by the Australian Prudential Regulation Authority (APRA). APRA determines how much money the lenders can hold in reserve compared to every dollar it can loan out.

Basel III, a set of global reform measures that ensure banks must hold more money in comparison to the amount they lend. This means the cost of lending money rises.

Loans to Suit Every Need

Our range of home loans have a broad selection of features, so you can find one that suits your requirements, not fit around someone else’s.

Award Winning

We’re one of Australia’s most awarded non-bank lenders, achieving accolade for our superior mortgage finance products and services.

Experienced Expert Lenders

Our Specialist Lenders are there for you, with one-on-one support throughout the lifespan of your loan. We listen to what you want, not just what we think you want.