What Does Comparison Rate Mean?

Every Bank and Lender has to show a comparison rate alongside the advertised rate by law, but not every borrower knows the difference between the two, or how to use them to their advantage when applying for a loan.

Your home is likely to be the biggest financial asset you purchase, and differences in interest rates and other loan costs can mean spending thousands more than you may need. This article aims to shed light on comparison rates across various loan types, to give you a better understanding of how to find the best loan for you.

What is meant by a comparison rate?

We’ll start at the top. A comparison rate is a legal requirement that lenders must show against their own advertised credit rates. A comparison rate helps keep lenders honest about any large fees that are played down by a low-interest rate. It helps the consumer identify the true cost of a loan.

While the interest rate (usually on the left) shows the interest you would pay on that specific loan product, the comparison rate indicates the percentage you would pay when you factor in other costs associated with servicing the loan over the long-term included in the loan repayments.

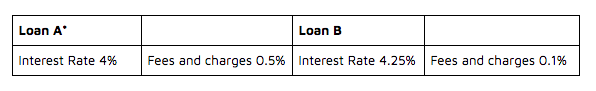

Many simply use the interest rates to compare loans and lenders, but it’s not always the lowest interest rate that gives you the lowest repayments. For instance:

Example loan A totals 4.5% comparison rate, and example loan B has a 4.35% comparison rate. Though Loan A may seem the better option from the interest rate, it’s Loan B that will cost you the least overall.

[*Example rate not indicative of any Mortgage House loan rate]

What is used to calculate a comparison rate?

There are many variables used to determine a comparison rate, including:

- Interest rate (this is the bulk of the percentage)

- Fees and charges (any fees charged from start to finish of your loan)

- Repayment frequency

- Loan term

- Loan amount

With that in mind, the other elements include fees and charges of the loan, which depends on your loan features and lender, may encompass the following:

- Upfront loan setup fees like application, valuation, processing fees, title insurance and lender legal fees

- Ongoing fees like monthly or annual account charges

- Exit costs like legal and discharge fees

Added together, they provide a truer cost of the loan on offer. You can then compare loans using both percentages, showing you which will cost you more altogether, or which has higher fees outside the interest rate. We’ll explain more of how to use these to your advantage later in the article.

There are various factors which would change a comparison rate, and each of these will change depending on the loan type, the features it includes, and the lender itself.

When you think of the interest rate as the base amount, then the difference between the interest and the comparison rate, after loan term and amount, is the percentage cost of ascertainable charges and fees.

Comparison rates cannot predict what may happen throughout your loan, therefore they do not include such things as redraw fees or early termination fees. Government and statutory charges also do not impact on the comparison rate as these are standard regardless of lender.

The following fees aren’t included in the comparison rate:

- Stamp duty, registration fees, and other government charges

- Conveyancing fees

- Late payment fees

- Break costs

- Deferred establishment fees

- Redraw fees

Are comparison rates based on certain loan amounts and terms?

Comparison rates are all calculated on a certain figure, and usually with home loans, this is not indicative of the loan you will need to take out. A home loan comparison rate in Australia is usually calculated based on a $150,000 loan and a loan term of 25 years.

As previously mentioned, a comparison rate must be taken as a guide to give you an idea of the true costs of maintaining your loan. Remember that when you look at comparison rates, the loan amounts and terms don’t cover all possible situations like incidental fees your lender may charge for making redraws, extra repayments or switching to a fixed rate from a variable, for example – so they may not be an accurate reflection of your particular loan. The amounts that a comparison rate is based on will be in the fine print. While comparison rates can be a good starting point, it’s also important to compare the other features of the loan to see if it works for you.

What’s the difference between the interest rate and comparison rate?

Interest rates tell you the percentage of interest you will pay as a result of taking out your loan. This will determine your monthly repayments, and rates fluctuate between each loan and lender, though all in Australia are generally based upon the movements of the RBA (the Reserve Bank Cash Rate).

Comparison rates, as explained above, take the interest rate on offer with that loan, and add to it the additional payments you will be required to pay throughout the life of the loan, equating in a percentage that is more akin to what you will pay in total costs on top of your loan.

Though they are more accurate to what you must pay back than interest rates alone, they should still only be used as a high-level indicator, as they cannot take every possible situation into account. To best utilise these rates, you should look for minimal gaps and differences between the advertised rate and the comparison rate.

How to use comparison rates to get the best loan

The more you know about the loan process and industry, the more educated your decision will be. This will usually mean you get a better deal than someone who picks and chooses their loan based only on the interest rate.

Knowing the costs involved and choosing your loan based on this information can save you thousands over the course of your loan. Hidden costs and fees aren’t ever a good surprise, so getting to know what you’re in for over the life of your loan is imperative. A low-interest rate may have these hidden costs and fees attached, compared to a higher interest rate with low fees – it’s not always obvious which is the best overall loan based solely on the interest rate. Knowing the costs and fees included in your loan will also help you to budget accordingly.

By looking into comparison rates, you are educating yourself on the loans you are assessing. This is important and only the start of the journey – it’s always a good idea to compare not only interest rates and fees but also the features you will likely need, such as free extra repayments, redraw facilities or an offset account. If your comparison rate is slightly higher, it may be because this loan encompasses some great features that may help you throughout the lifetime of your loan. Looking at the interest rate, comparison rate, and features combined will ensure you get the best loan for your needs.

What does it mean if the comparison rate is similar to the interest rate?

The closer the comparison rate is to the headline interest rate, the fewer fees and charges you will be paying throughout the life of your loan. While this is a good thing as you won’t be charged extra fees on top of your interest, you may find other lenders or loans who do charge fees still have a lower comparison rate, usually due to a lower initial interest rate. This is why it’s imperative to compare all interest rates and comparison rates, not forgetting to take into account all features you’d enjoy with each loan.

What does 0 comparison rate mean?

A comparison rate of 0% sounds like an enticing deal, but no finance company can lend money out for free. Usually seen in car loans, a comparison rate of zero means the product will have an inflated price to pay back the finance lender, instead of the customer paying it back themselves.

How is a comparison rate calculated?

The comparison rate is calculated with the base interest rate of the selected loan and then selecting the costs and fees of that loan and lender to add to this rate. Under the Uniform Consumer Credit Code (UCCC), the comparison rate calculation includes the following:

- Loan amount of $150,000

- Loan term of 25 years

- Repayment frequency

- Interest rate

- Monthly account fee (if any)

- Annual fee (if any)

- Establishment fee (if any)

- Valuation fee (if any)

- Mortgage documentation fee (if any)

- Settlement fee

As home loan comparison rates are usually calculated on a $150,000 loan over 25 years, though being truer than the interest rate alone, it probably won’t give you the true percentage of what you will pay on your mortgage.

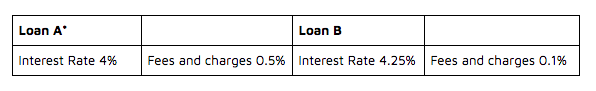

The calculation of a comparison rate is complex, so this is where a home loan calculator comes in. Our Best Rate Mortgage Calculator and Mortgage Repayment Calculator can help you identify what your accurate comparison rate will be.

Should I use a comparison rate or variable rate to compare loans?

A variable rate is a loan type where the interest fluctuates depending on the market. It is the most common loan type option, above fixed rate and split loans. Variable rates often have lower interest rates than fixed, as there is no certainty that the rate will stay the same over the life of the loan.

It’s a good idea to always compare both interest and comparison rates to ensure you are getting the best deal. It’s also important to look at the loan type you want to pursue (if you have decided between fixed, variable, or split!) and then compare loans of the same interest structure.

Looking at Mortgage House loan types and comparison rates

Interest and comparison rates are advertised across all types of loans – home loans, term deposit, car loans and personal loans.

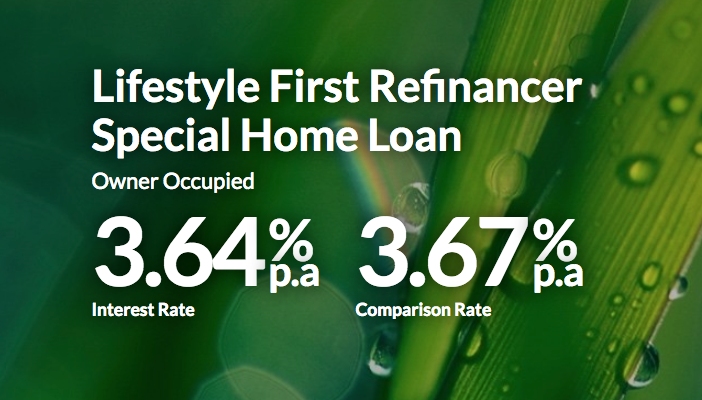

Home Loan Interest Rate

Buying a house is generally the biggest loan you will ever take out, and interest rates are hugely important when looking for the best loan. In fact, it’s generally the interest rate which is the deciding factor, as this is what will most affect your repayments.

A home loan comparison rate is usually worked out using an example loan amount of $150,000 over 25 years.

This is an example only. Interest rates and comparison rates will fluctuate based on market movements.

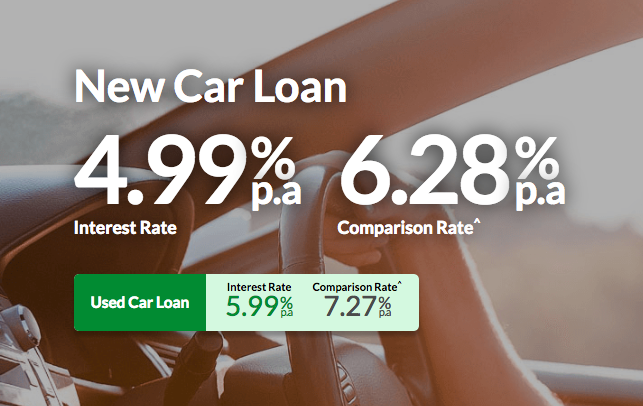

Personal Loan and Car Loan Comparison Rate

When cash flow isn’t allowing you to do the things you want or need, like planning a wedding, doing home renovations or buying a vehicle, a personal loan can be the just the thing you need.

Many individuals or businesses will need to take out a loan, in order to purchase or lease a car. Mortgage House offers new and used car loans, and can refinance existing car loans for a better deal. With Mortgage House, if you already have a home loan with us, you automatically satisfy the initial requirements to take out a car loan.

With a personal loan, you also have the option to consolidate your debt which can lower your interest rate and make it far simpler to pay every month.

Many lenders, including Mortgage House, provide a comparison rate based on a $30,000 loan over a 5-year term. It important to calculate what you would be spending based on your requirements, as they may likely differ from the example.

This is an example only. Interest rates and comparison rates will fluctuate based on market movements.

Summary

It’s important to consider the comparison rate as well as the interest rate when looking for a loan. To take out the best loan for your needs, you must have all the information at hand so you don’t get any unwanted surprises in the form of any ‘hidden’ fees later on.

Mortgage House

At Mortgage House, we’re no strangers to the homeowner’s journey. It’s a long (but rewarding) one.

But don’t worry, we can help with that.

If you’re thinking of selling your home and are ready to make the next move buying or investing, you can contact us for information about the best options for you when it comes to your mortgage.