Buying your second home

When you bought your first home, there was a lot to consider, and doing it successfully required careful planning. Buying your second home is no different, and you should conduct the same groundwork to ensure a smooth transition into your second home.

Take a look at our tips below to help you successfully buy your second home.

1. Review your current home loan

Your current home loan may no longer be the best home loan for you, particularly if your circumstances are changing and you are buying a second home.

To ensure you have the most suitable home loan, use our switching mortgage calculator. You may be able to save thousands by switching to a home loan that meets your current needs.

2. Calculate your borrowing power

Since buying your first home, it’s likely your circumstances have changed which means your borrowing power will be different to when you first bought a home.

You may be eligible to borrow much more if you have built significant equity in your current home, but if you are earning less due to a job change or starting a family then your borrowing power may be reduced.

To give you an idea of what you can afford, estimate your borrowing power using the Mortgage House ‘How much can I borrow’ calculator.

3. Limit credit cards and consolidate personal loans

Buying a second home often comes with a bigger price tag. Increase your borrowing power by minimising your existing debt. This means limiting credit cards and consolidating personal loans.

Reduce the number of credit cards you have, as well as your credit card limits. If possible pay off personal loans or if you have multiple personal loans, consolidate them.

These actions can all help to improve your credit score which lenders will look favourably upon.

4. Find the best interest rate

A lower interest rate can dramatically reduce the amount of interest you pay and take years off the life of your loan. Buying your second home is a great time to review your current interest rate and negotiate a better deal.

Use our best rate mortgage calculator to find low-interest rates you may be eligible for.

5. Budget accordingly to maintain cash flow

There are a number of costs associated with buying a second home, including purchase costs, increased repayments, lenders mortgage insurance, rates and insurance.

Careful budgeting is essential to maintain cash flow and stay on top of your repayments. Use our free online budget tool to help you create a budget.

6. Account for lenders mortgage insurance

Lenders mortgage insurance (LMI) doesn’t just apply to first home purchases. If you paid LMI on your first home purchase you may need to pay it again on your second home. Even if you didn’t pay LMI on your first home purchase, you may have to pay it on your second home if your deposit falls under 20% of the purchase price. Be sure to account for this additional cost.

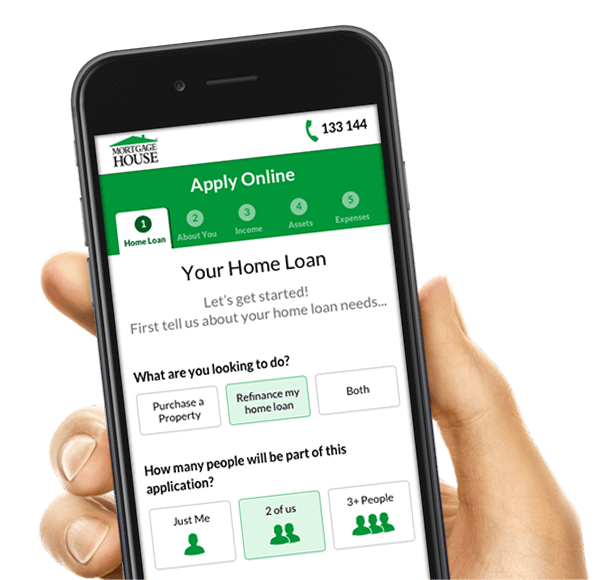

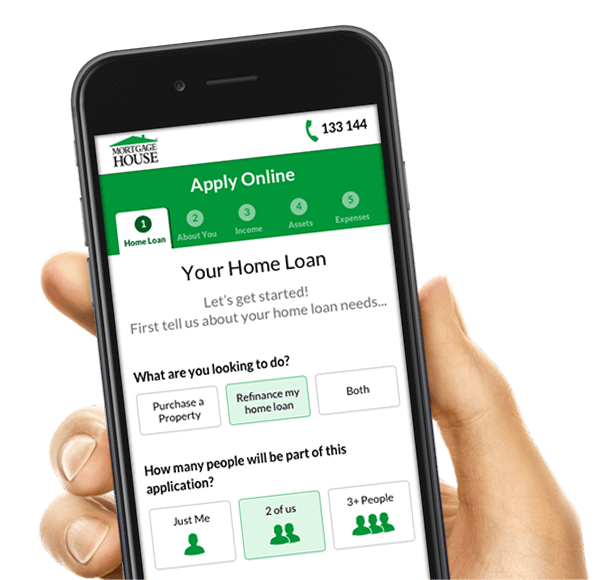

To get the ball rolling, simply start an online application for a home loan by clicking below! It can take 15 minutes or even less to begin the exciting journey toward your second home.

Apply Online Anywhere, Anytime.

Less paper work

& waiting time

Complete the

form in 15 minutes

Save and come

back anytime

How much can you borrow?

Important Disclaimer: This is intended as a guide only. Details of terms and conditions, interest rates, fees and charges are available upon application. Mortgage House's prevailing credit criteria apply. We recommend you seek independent legal and financial advice before proceeding with any loan. The Comparison Rate for each of the home loan products contained in this page is based on a loan of $150,000 over a 25 year term. Fees and charges may be payable.

WARNING: The comparison rate is true only for the examples given and may not include all fees and charges. Different terms, fees or other loan amounts might result in a different comparison rate. * This mortgage calculator shows indicative repayments based on 12/26/52 equal repayments for monthly/fortnightly/weekly options.