I Want To...

Compare Home Loans

Instantly compare up to 5 different loan products to find the best option.

Access Loan Resources

Enjoy free home loan tips, expert guides, checklists, calculators & more.Use Loan Calculators

Get instant visibility over loan savings, repayments, borrowing capacity + more.Refinance My Loan

All the tools at your fingertips to Switch & Save with a low rate home loan.Buy My First Home

Be well-informed and ready for your stress-free first home ownership journey.Invest In Property

Evaluate investment loan rates, access valuable tools and the latest investor news.

Find A Branch

Find your nearest Mortgage House Branch and useful contact information.Mortgage House Makes Lending Easier

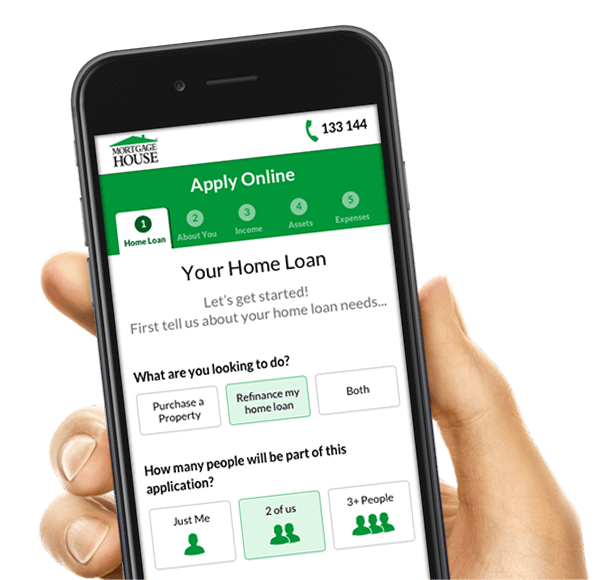

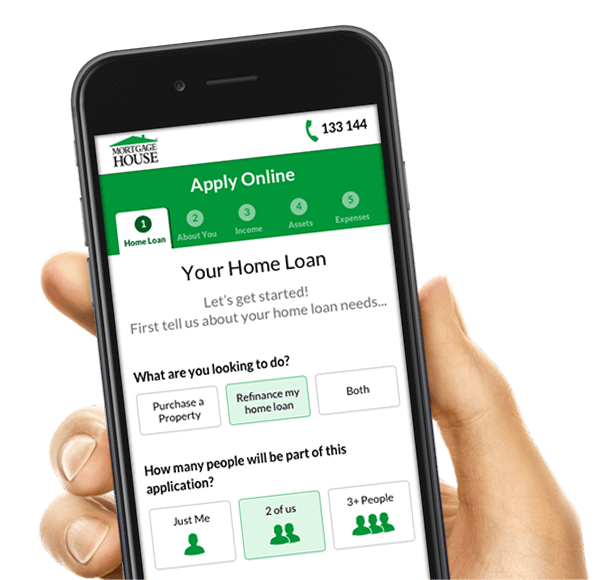

State-of-the-art online processes for quick applications and loan comparison.

Home loan products and services tailored to your lending needs.

Expert advice and online home loan guides for every type of borrower.

Experience our 5-star Service

and the Feeling of Home Ownership Happiness

For more than 35 years we have been helping Australian borrowers achieve their dreams of home ownership. You deserve to be in the safest hands when securing a new or refinanced home loan. Enjoy the confidence of knowing that our Lending specialists will find you the best low-rate loan to suit your needs from our award winning low-rate loan product range. Let us help you navigate the best way to home ownership happiness.

The Advice

You Deserve

We are committed to providing you with relevant and transparent home loan lending advice so you can make the best financial decisions.

The Flexibility

You Need

Save time and stress with our state-of-the-art online resources and tools. Anytime, anywhere, you can access calculators, tips, loan rates, pre-approval and more.

The Experience

You Trust

We have been supporting Australian borrowers with flexible loans and advice through decades of market fluctuations. You are always in safe hands with us.

The Best Home Loan Products

Our leading home loans are designed with YOU in mind. Get a tailored home loan andspecialised service to maximise your savings.

How to Find the Right Home Loan for Your Situation

Whether you are looking to buy your first home, building up a portfolio, consolidating debt, refinancing your loan or simply want reliable information to help steer you in the right direction, we welcome you to explore our home loan guides.

Find the Right Home Loan for You

Our mission at Mortgage House is to equip you

with the tools and information you need

Feel in control and in the know at every stage of your lending journey. These online tools create light work of complex processes to give you instant visibility to things like your borrowing capacity, optimal budgeting, best home loan rates, home loan comparisons, useful checklists to keep you organised and much more.

Our friendly Lending Specialists understand that every borrower has unique home loan requirements. by our experience working with Australians since 1986. |

|||

Australia-wide Lenders Wherever you are, we can help to guide you and set you up for loan success. |

Your Questions Answered Home loans are a major commitment and we want to equip you with valuable information and advice. |

Award Winning Products & Services Year on year Mortgage House continues to lead the way with exemplary offerings for new and existing customers. |

|

Our Success is Your Success

We continue to achieve industry recognition for excellence in customer service and low-rate loan products. When you come to Mortgage House, know that you are in the safest hands.

We continue to achieve industry recognition for excellence in customer service and low-rate loan products. When you come to Mortgage House, know that you are in the safest hands.

WeMoney

Best Low Deposit Home Loan of the YearBack to Back Winner 2023-2024 (2 years)

ProductReview.com.au

Home Loans - 2023 Winner

Money Magazine

Best-Value Basic Home Loan(Non-Bank) 2022

RateCity

Best Variable Home Loanfor the Chameleon Executive Home Loan 2022

Our team is your team. We believe there is Always a Way to move towards property ownership success.

Find your nearest branch or call 133 144 to be connected to

a friendly Lending Specialist near you.