Why Choose Mortgage House Home Loans?

Loan Solutions

Whatever your circumstances we have a home loan to suit.

Simple

Application Process

Apply online, anywhere, anytime and receive a swift response from a lending specialist.

Lowest

Rate Loans

Save money and pay less each month with the best low rate mortgage product.

Value-adding

Loan Features

BPAY, loan splitting, loan portability, offset accounts, no monthly fees and more. Whether you are looking for a variable, fixed, portable, interest only, refinancer loan or otherwise we have the best advice and products.

All you need to know

All you need to know

What types of mortgages does Mortgage House offer?

Mortgage House is one of Australia’s largest independently owned non-bank lenders. We have helped Australians achieve their dream of homeownership since 1986, and we have expert lending specialists who can help you do it without all the mortgage jargon. With a large range of different types of home loans, Mortgage House works closely with you to find one suited to your situation. Some mortgage types require deposits, others require more paperwork than others, and some can allow you to get a little help from your family to make your dreams happen. There are many options when it comes to choosing a home loan.

The ‘Top 10’ mortgage types we offer are:

Variable Rate Home Loan. Our most common home loan, where the interest rate can increase or decrease over the life of the loan, depending on a range of internal and external factors.

Fixed Rate Home Loan. Fixed rate loans are what they sound like. The interest rate is fixed over a period of time, with most lenders fixing them for between 1 and 5 years.

Toggle Offset Home Loan. This home loan gives you the flexibility of both a fixed and a variable mortgage. The mortgage is split between the two options, allowing you to toggle between the two when it benefits you most, to maximise interest savings.

Split Home Loan. Similar to Toggle Offset, Split home loans have portions that are both variable and fixed. The main difference is there are no restrictions on how much can be fixed and how much can be variable.

Portable Home Loan. With most people not staying in the one house over the entire life of their home loan, portable loans allow you to take your mortgage with you when you move.

Interest Only Home Loan. These home loans allow you to only repay the interest portion of the mortgage, usually for a fixed period only. These mortgages can free up money for other things and are popular with investors.

Line of Credit. We all want the luxury of having access to money when we need it, and a Line of Credit can do just that. Line of Credit loans can be for mortgages or personal loans and gives you an approved amount to help you afford what you need, quickly.

Low Doc Home Loan. If you are unable to provide evidence of regular income or full financial statements, Low Doc home loans can help. They are popular with self-employed people and freelancers.

Construction Home Loan. If you are building a home, a Construction loan can help you save money. Instead of paying upfront when you sign a contract, Construction loans allow you to pay builders in agreed stages, once sections of your home have been finished. You are only charged interest on the amount you have paid out.

Bridging Loan. If you are buying a new home and haven’t sold your current one, then a Bridging loan can help you bridge that gap.

If you are thinking of switching loan types, use our interactive Switching Mortgage Calculator to compare your options

How much can I borrow?

At Mortgage House, you can get an indication of how much we might be able to lend you, by using our borrowing calculator. All you need to do is enter your income and expenses, and details of the loan you are looking to apply for. It is important to remember that our borrowing calculator is only a guide and doesn’t equate to pre-approval. Even if the results you get aren’t what you are looking for, contact our expert lenders and we will help you find a solution.

Try our helpful Mortgage Borrowing Calculator to get clarity in less than 5 minutes.

Fixed vs variable – which is better?

Variable and fixed rate home loans have many, and different, advantages. Choosing which one suits you comes down to a range of personal factors, financial circumstances and preferences.

Advantages of variable rate home loans

- The variable home loan interest rate is generally lower than a fixed rate mortgage

- Your home loan repayments will normally be lower than for a fixed rate mortgage

- You can usually make extra repayments without penalty with a variable interest rate, giving you more flexibility

- You usually have access to a redraw facility on variable home loans, which further reduces your interest payments

Advantages of a fixed-rate home loan

- Budgeting your finances can be easier, as your home loan repayments remain consistent even if interest rates rise

- Eliminate the risk of defaulting on your home loan as a result of variable interest rate increases

- Make additional payments of up to 5% for most Fixed mortgages or up to $20,000 on Progressive Fixed mortgages in a 12-month period

- Some fixed home loans have offset accounts and redraw facilities

How can I pay less interest?

At Mortgage House, we have a range of both fixed and variable rate home loans that include features to help you pay off your mortgage sooner. Paying off your mortgage sooner can save you thousands in interest payments.

Find a mortgage that allows additional repayments. Making additional repayments is a great way to save money and pay off your loan sooner. Banks and lenders will give you the minimum repayments they require you to make each week, fortnight or month. Use our Mortgage Repayment Calculator to see how much you can save by making extra repayments and paying off your home loan sooner. Short-term pain can certainly mean long-term gain. If you intend to make extra repayments as you go, regularly or often, make sure you choose a loan that doesn’t penalise you for doing it.

Redraw. Redraw works alongside your additional repayments, by giving you extra flexibility. It can encourage you to make extra repayments or lump-sum payments, in the knowledge that if you want to withdraw them at a later date, you can, without being penalised.

Offset Facility. A lot of Mortgage House home loans feature an Offset Facility. Offset allows you to offset an existing non-interest bearing bank account against your mortgage account. If your mortgage is $400,000 and you have an offset account with $50,000 in it, then you only pay interest on $350,000.

Attractive interest rates. By comparing interest rates and home loan features, you will discover the value of choosing Mortgage House.

Refinance your loan. Finding a home loan with a better interest rate is an obvious way to pay less. It may have been a while since you first took out your mortgage, and there may be better interest rates on the market.

In the current climate, it is worth doing a Home Loan Health Check of any existing loans to make sure you are paying the least interest possible.

How much interest will I pay?

Interest rates can often be in a state of flux, and how much you pay usually depends on what kind of loan you have, and how much your loan is for. If you have an investment loan, you are likely to pay a higher interest rate than a residential home loan. At Mortgage House, we know how important it is to have as much information as possible before you choose a loan. A home is likely to be the most expensive thing you purchase in your lifetime, so it is important to know all the facts before you sign up. Knowing how much interest you will pay can also spur you on to pay your home loan back sooner.

Should I refinance my current home loan?

Giving your existing home loan a health check every now and again is always good practice. It is important to check regularly whether or not your home loan is working for you, and whether it is meeting your current requirements. Life changes, and so do your financial circumstances, so it only makes sense that your home loan should, too. And what is on offer in the market can also change. New features, better interest rates and more flexibility can make modern mortgages more attractive than the one you first took out. Refinancing can help you:

- Improve your cash flow

- Reduce your interest rate

- Restructure your debt to save money

- Reduce your home loan repayments

- Unlock equity in your home

- Minimise your mortgage

See how much money you could save by refinancing to a lower rate loan by calling a friendly Lending Specialist on 133 144.

How much will it cost to refinance my loan?

Refinancing your current home loan can save you money in the long term, but there can be costs and fees associated with doing it. It is always worthwhile to understand what these are before deciding to refinance. If you are unsure whether these costs outweigh the benefits of a new Mortgage House home loan, speak with our expert lenders, and we will walk you through the full process in detail. Alternatively, speak with your current or new lender. As a general rule, refinancing your home loan can cost anywhere from $500 up to $2000, but the benefits can be a lot higher.

| Current Lender | New Lender |

| Discharge and registration of mortgage fees | Home loan application fee |

| Deferred Establishment fee (DEF) – applies if you refinance within a certain period of time |

Valuation fee (of the property) |

| Break Costs (applicable for loans with a fixed interest rate) | Loan-legal fees |

| Registration of mortgage fees | Settlement fee |

| New stamp duty if you borrow more than your original loan (not applicable in all states and territories) |

Stamp duty – how much will I pay?

Stamp duty is a tax on transactions. As well as property, stamp duty can also be paid on car registrations and purchases, and insurance. Stamp duty is administered by state governments, so how much you pay depends on where you live. States can also offer stamp duty exemptions to some home buyers, such as those looking to purchase their first house, as a way of helping them get into the property market. Another factor in how much you pay in stamp duty is the cost of your home. In most cases, stamp duty is calculated on the value of the transaction. However, if you are buying a house and land package, most states only charge stamp duty on the value of the land, making building more affordable.

Try our helpful Stamp Duty Calculator.

How much does it cost to build a house?

If you are building a home, and you want to know how much it may cost, then Mortgage House can help. Our table can give you an understanding of what it may cost to build versus buy, giving you an idea of whether or not that suits your financial position. Remember that where you live can impact how much it costs to build.

| Construction Type | Level of Finish | ||

| House | Low | Medium | High |

| 3br brick veneer project home, level block, single level, shelf design | $1,065 | $1,270 | $1,630 |

| 3br full brick project home, level block, single level, shelf design | $1,090 | $1,305 | $1,670 |

| 4br brick veneer home, level block, single level, unique design | $1,570 | $1,750 | $1,950 |

| 4br full brick home, level block, single level, unique design | $1,640 | $1,810 | $2,010 |

| 3br brick veneer project home, level block, two level, shelf design | $1,110 | $1,310 | $1,710 |

| 3br full brick project home, level block, two level, shelf design | $1,130 | $1,400 | $1,790 |

| 4br brick veneer home, level block, two level, unique design | $1,700 | $1,900 | $2,050 |

| 4br full brick home, level block, two level, unique design | $1,780 | $1,970 | $2,250 |

| Architecturally designed executive residence | $2,160 | $3,250 | $5,050 |

The above rates are exclusive of GST.

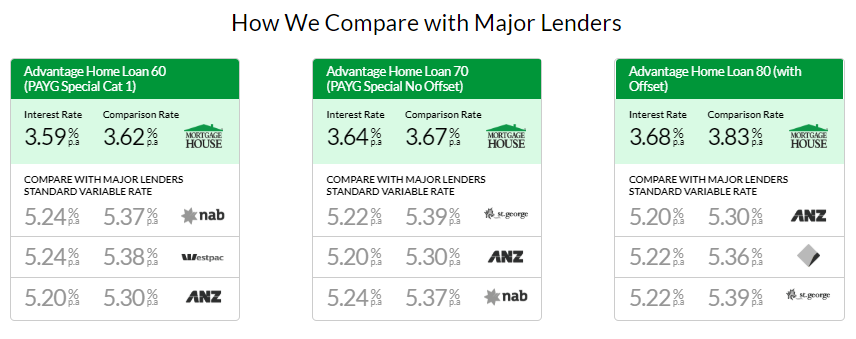

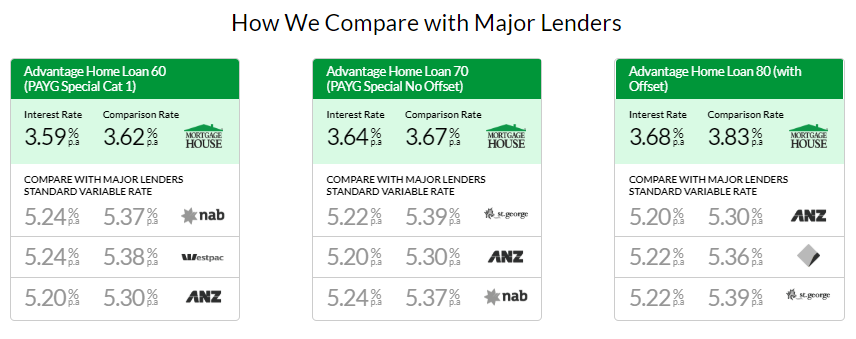

How does Mortgage House compare to other lenders?

At Mortgage House, we are proud to say we are different. From our humble beginnings more than 30 years ago, we have understood the limitations of the mortgage market, and what those limitations mean for people looking to buy their dream home or make that dream investment. We decided to focus on being competitive with our rates, to offer diversity with what we can offer and provide a level of customer service that, until now, was unheard of in the mortgage industry. Our philosophy is to provide loan, product and service outcomes tailored to the exact needs of every client by;

- Actively listening to our customers’ needs, not what we think their needs may be

- Always identifying the best loan and mortgage finance products and options for each customer

- Providing ongoing support throughout the life of the loan

- Engaging our specialist technology to ensure a simple and seamless process for the customer

- Providing the customer all the tools, knowledge and experience that Mortgage House can provide.

Find out how we can help you save money on your home loan and find the best solutions to suit your lending needs by calling 133 144.

Know where you stand with helpful calculator resources

Know where you stand with helpful calculator resources

Whether you are completely new to the home loan process or a seasoned borrower, our calculator tools will give you valuable visibility over your finances.

Borrowing Calculator

Important Disclaimer: This is intended as a guide only. Details of terms and conditions, interest rates, fees and charges are available upon application. Mortgage House's prevailing credit criteria apply. We recommend you seek independent legal and financial advice before proceeding with any loan. The Comparison Rate for each of the home loan products contained in this page is based on a loan of $150,000 over a 25 year term. Fees and charges may be payable.

WARNING: The comparison rate is true only for the examples given and may not include all fees and charges. Different terms, fees or other loan amounts might result in a different comparison rate. * This mortgage calculator shows indicative repayments based on 12/26/52 equal repayments for monthly/fortnightly/weekly options.

Repayment Calculator

Important Disclaimer: This is intended as a guide only. Details of terms and conditions, interest rates, fees and charges are available upon application. Mortgage House’s prevailing credit criteria apply. Please note that your actual fortnightly repayment would be equal to the monthly repayment amount divided by two. Weekly repayments would equal the monthly repayment amount divided by four. If you choose to pay fortnightly or weekly, your actual repayments will be higher than repayments shown on this page. You can reduce the term of your loan if you choose to make repayments fortnightly or weekly. We recommend you seek independent legal and financial advice before proceeding with any loan.

Best Rate Calculator

Important Disclaimer: This information is intended as a guide only. The calculation of fortnightly and weekly instalments varies with the specific loan product. Higher loan repayments will be required on principal and interest loans where the instalment calculation is based on half the monthly payment for a fortnightly payment or a quarter of the monthly payment for a weekly payment. Details of terms and conditions, interest rates, fees and charges are available upon application. Mortgage House's prevailing credit criteria apply. We recommend you seek independent legal and financial advice before proceeding with any loan.

Switching Loans Calculator

Important Disclaimer: This is intended as a guide only. Details of terms and conditions, interest rates, fees and charges are available upon application. Mortgage House's prevailing credit criteria apply. We recommend you seek independent legal and financial advice before proceeding with any loan. * The interest rate shown on Toggle products is a blended rate comprised of 50% fixed interest rate and 50% variable interest rate. The Comparison Rate for each of the home loan products contained in this page is based on a loan of $150,000 over a 25 year term. Fees and charges may be payable. * This mortgage calculator shows indicative repayments based on 12/26/52 equal repayments for monthly/fortnightly/weekly options.

WARNING: The comparison rate is true only for the examples given and may not include all fees and charges. Different terms, fees or other loan amounts might result in a different comparison rate.

Stamp Duty Calculator

Ms Colbran is SAVING $520 per month

when she switched to Mortgage House

""I found the process to be seamless. I saved approximately $120.00pw and borrowed almost 20k more.""

View all testimonials